On the evening of January 12, GenBridge portfolio Yuen Kee Food officially submitted its prospectus to the Hong Kong Stock Exchange.

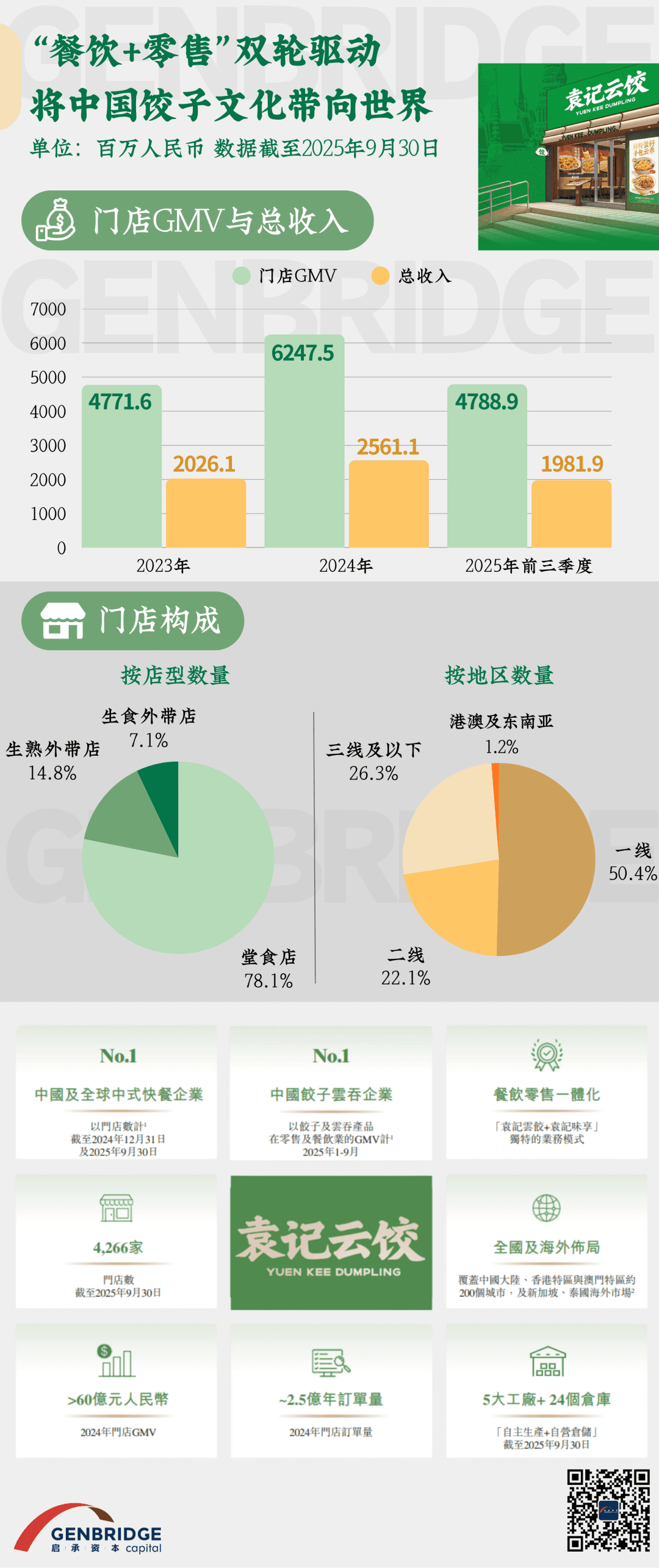

Yuen Kee Food operates the foodservice brand “Yuen Kee Dumpling” and the retail brand “Yuen Kee Weixiang.” According to the prospectus, as of September 30, 2025, Yuen Kee operated 4,266 stores across China and Southeast Asia. Yuen Kee Food has now become the largest Chinese fast-food company in China and globally, and also the largest dumpling and wonton company in China.

In 2023 and 2024, Yuen Kee Food recorded revenues of RMB 2.026 billion and RMB 2.561 billion, respectively, representing year-on-year growth of 26.4%. In the first three quarters of 2025, revenue increased by 11.0% year-on-year to RMB 1.982 billion.

GenBridge Capital believes that as online and offline consumption scenarios continue to converge, and as supply chains and operating models in foodservice and retail increasingly align, the boundary between retail and dining will continue to blur. Participants are no longer confined to their traditional formats, but instead compete for consumers’ dining needs across specific scenarios.

Over its 14-year history, the development of Yuen Kee Dumpling represents a distinctive case of integrated growth between food service and retail.

When it was first founded in 2012, Lianghong Yuan, its founder, opened the first stall in a wet market in Liwan District, Guangzhou. The stall measured just five square meters and served freshly wrapped and cooked Cantonese dumplings and wontons to local residents.

In 2017, as the dumpling and wonton business expanded across South China, it was officially renamed “Yuen Kee Dumpling” and began exploring an integrated “raw-and-cooked” store model:

Starting from retail stores focused on takeaway of raw products, the brand gradually added cooked takeaway offerings; after entering East China, dine-in became the primary format. As of September 30, 2025, Yuen Kee Dumpling operated three types of stores—dine-in stores, integrated raw-and-cooked takeaway stores, and raw-only takeaway stores—to meet different consumer needs. Dine-in stores accounted for 78.1% of total outlets, integrated stores for 14.8%, and raw-only takeaway stores for 7.1%.

With this integrated raw-and-cooked model, Yuen Kee Dumpling stores function as “family kitchens” for local communities. Through dine-in, cooked takeaway and delivery, and raw takeaway options, the brand satisfies customers’ diverse needs for “three meals a day plus snacks at any time”—an advantage difficult for traditional single-format restaurants to replicate.

As Lianghong Yuan, founder of Yuen Kee Dumpling, stated at the 2025 GenBridge Partners Gathering: “We don’t define ourselves as a restaurant or a retail store. We’re more like a community dumpling kitchen. If customers want convenience, they buy cooked dumplings; if they want to cook at home, they buy raw dumplings—different products for different scenarios.”

In 2020, when dine-in services nationwide were suspended, Yuen Kee leveraged its “fresh takeaway + delivery” model to seize a critical window of opportunity, with store count surging from just over 500 to nearly 1,000 within the year.

Thereafter, Yuen Kee entered a phase of accelerated expansion. As of September 30, 2025, Yuen Kee Dumpling operated more than 4,000 stores, becoming the largest Chinese fast-food company in China and globally by number of outlets.

The rapid growth of Yuen Kee Dumpling is closely linked to the inherent potential of the dumpling category itself.

Standardization has long been a challenge in the expansion of Chinese food chains. However, dumplings and wontons—thanks to standardized production processes and broad consumer acceptance—possess greater scalability potential. According to CIC Consulting, driven by consumers’ shift toward freshly prepared food, ongoing category innovation, and continuous improvements in store operations, the dumpling and wonton foodservice market is expected to grow from RMB 118.9 billion in 2024 to RMB 211.6 billion by 2030, at a compound annual growth rate of 10.1%.

The large market base and user population, combined with ease of standardized production, make dumplings one of the most promising categories for achieving 10,000-store scale in Chinese foodservice. Meanwhile, low industry concentration provides leading chain brands with substantial room for consolidation and expansion.

More importantly, Yuen Kee Dumpling has demonstrated strong adaptability and iterative capability amid an increasingly complex competitive landscape.

As Lianghong Yuan noted at the 2025 GenBridge Portfolios Annual Gathering, competition is no longer confined within the same formats: “In the past, it was restaurant versus restaurant, retail versus retail. Today, we may compete with fast-food outlets on Meituan delivery, and with wet markets in community group buying.”

Against this backdrop, Yuen Kee Dumpling has proactively adjusted its strategy, building a diversified product matrix and continuously innovating to win consumer trust through quality. As of September 30, 2025, the brand offered approximately 350 SKUs nationwide and had launched more than 200 new SKUs, with its signature dumpling and wonton series accounting for over 80% of store GMV.

Beyond the “Yuen Kee Dumpling” brand, the group has also launched a packaged food retail brand, “Yuen Kee Weixiang,” with 34 SKUs as of September 30, 2025. This further expands the business footprint, strengthens brand influence across both foodservice and retail consumers, and highlights the integrated foodservice–retail business model.

Yuen Kee Dumpling’s ability to expand rapidly while maintaining quality control and cost advantages is largely attributable to its robust supply chain system and strong resource integration capabilities.

As a representative of “manufacturing-oriented foodservice,” Yuen Kee has built a comprehensive central factory network. It currently operates five self-owned modern production facilities in locations including Foshan, Guangdong, and Suzhou, Jiangsu, along with 24 self-operated warehouses covering major markets nationwide, supplemented by forward warehouses established in partnership with third parties. As of September 30, 2025, over 86% of Yuen Kee Dumpling stores were located within a 200-kilometer radius of a self-operated or forward warehouse.

Yuen Kee Dumpling is one of the few Chinese fast-food brands in the industry to utilize full cold-chain logistics, covering central factories, warehousing, and store distribution, with end-to-end temperature-controlled visibility.

According to CIC Consulting, Yuen Kee Dumpling’s inventory turnover outperforms the market. In 2024, its inventory turnover period was 12.1 days, significantly lower than the industry average of 25 days. Core ingredients such as fillings and wrappers are delivered to nearly 70% of stores every two days, ensuring efficient supply and timely sales of short-shelf-life products.

While steadily expanding domestically and continuously refining its products and operating model, Yuen Kee Dumpling has also begun taking its dumplings overseas.

According to Frost & Sullivan, the overseas Chinese foodservice market is projected to reach USD 410 billion by 2026. As of September 30, 2025, Yuen Kee Dumpling had opened five stores in Singapore. According to official announcements, its first store in Thailand also officially opened in December 2025.

Yuen Kee Dumpling Singapore store

In local operations, the brand is not limited to mall-based stores, but also enters hawker stalls and community stores to stay close to local lifestyles. At the same time, the brand maintains a craftsman’s mindset, leveraging its well-established domestic supply chain and local partners to ensure stable ingredient supply for overseas stores, faithfully recreating the authentic taste of Chinese dumplings and wontons around the world.

For Yuen Kee Food, the objective of going overseas is not fragmented geographic coverage, but the creation of a coherent business footprint. Going forward, the company will comprehensively consider factors such as population size, economic growth, income levels, local culture, and dietary preferences to further expand its overseas presence.