On the evening of January 12, GenBridge partner company Qiandama formally submitted its prospectus to the Hong Kong Stock Exchange.

According to the prospectus, Qiandama was founded in 2014 and is committed to providing consumers with highly fresh products offering strong value for money, along with a convenient shopping experience centered on “three meals a day.” It pioneered the “daily clearance discount” sales model, strictly adhering to the standard of “never selling overnight meat,” which is applied across all fresh food products.

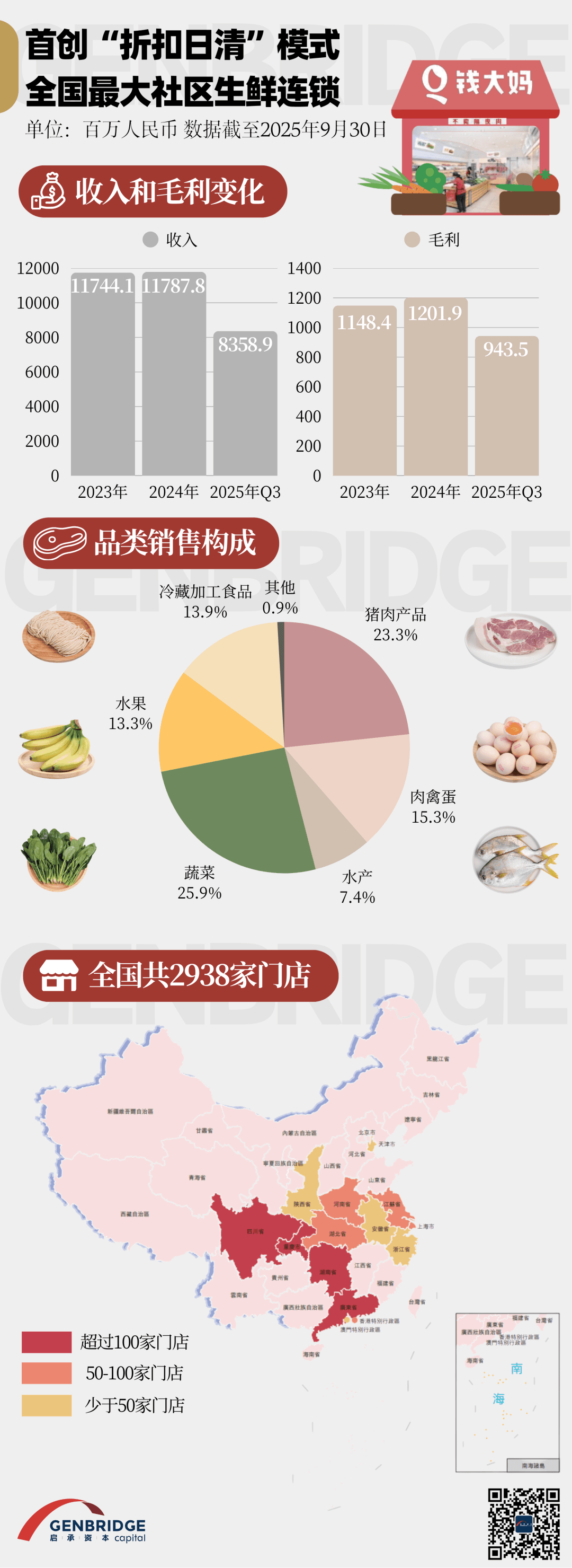

In 2024, Qiandama achieved GMV of RMB 14.8 billion. According to a report by CIC Consulting, within China’s community fresh food retail chain industry, Qiandama has ranked first for five consecutive years by fresh food GMV, making it the absolute leader in the South China community fresh retail market. As of September 30, 2025, Qiandama operated 2,938 stores across 14 provinces, municipalities, and special administrative regions.

Qiandama was the first investment made after GenBridge Capital was formally established, and also GenBridge’s first “narrow gate” into the retail sector. In 2017, when the GenBridge team first encountered Qiandama, they were immediately drawn to its sharp and distinctive business model.

At the time, Qiandama had fewer than 200 stores, yet it was already deeply embedded in everyday local life. In Guangzhou, residential communities with Qiandama stores were often referred to as “Qiandama communities.” Qiandama had become synonymous with convenience and freshness, even serving as a unique locational advantage. Every evening at 8 p.m., Qiandama stores were bustling with activity, as uncles and aunties skipped their square dancing to hunt for great deals.

At Qiandama, “never selling overnight meat” is not merely a memorable slogan, but the clearest expression of its business model innovation: consumers purchase fresh meat at discounted prices and enjoy tangible savings; retailers efficiently manage shrinkage and operations, while also reducing the risks and complexity of franchise management.

Over the past few years, GenBridge Capital has witnessed Qiandama grow from 200 stores to nearly 3,000, expanding beyond South China into Hunan, Hubei, and Sichuan. We have seen Qiandama firmly occupy consumer mindshare around “freshness” and “convenience,” while gradually demonstrating capabilities in larger-format “fresh produce+” stores.

From south China to nationwide expansion

Qiandama’s story can be traced back to 2012. When it opened its first store in Dongguan, Guangdong, it established the “daily clearance” model of “never selling overnight meat,” initially focusing on pork and vegetables as core categories, securing a strong foothold locally through superior freshness.

From 2014 to 2018, Qiandama embarked on expansion, rapidly scaling across cities in Guangdong, surpassing 700 stores, and opening its first store outside the province in Hong Kong, while expanding its product range to include fruits.

Between 2019 and 2021, Qiandama entered a fast track of nationwide expansion, covering up to 40 cities at its peak, surpassing 2,000 stores, and exceeding RMB 10 billion in nationwide sales. Digitalization efforts accelerated in parallel.

Starting in 2022, Qiandama entered a “U-shaped recovery” phase, shifting its strategic focus from store count expansion to optimizing single-store economics. Through strengthening the supply chain, upgrading digital systems, and optimizing organizational structure, both store-level and group revenues stabilized, with profitability improving significantly.

Today, the South China market has become Qiandama’s solid “home base.” According to CIC Consulting, based on 2024 fresh food GMV, Qiandama is the absolute leader in the South China community fresh retail market, with GMV of approximately RMB 9.8 billion—2.8 times that of the second-largest market participant. The prospectus shows that in 2023, 2024, and the nine months ended September 30, 2025, gross margins in the South China region were 11.4%, 11.5%, and 12.5%, respectively, demonstrating a steady upward trend.

Under the community small-store format, a stable base of high-frequency consumers has delivered strong sales efficiency per square meter. In 2024, the sales efficiency of Qiandama’s self-operated stores in Guangzhou was approximately six times that of large supermarkets, three times that of community convenience stores, and twice the overall average of community fresh retail chains.

Store density within a region also generates spillover effects for surrounding areas. Leveraging its mature supply chain infrastructure in South China, Qiandama expanded into the Greater Bay Area. As of September 30, 2025, Qiandama operated 72 stores in Hong Kong and Macau, achieving a gross margin of 18.5% over the past nine months.

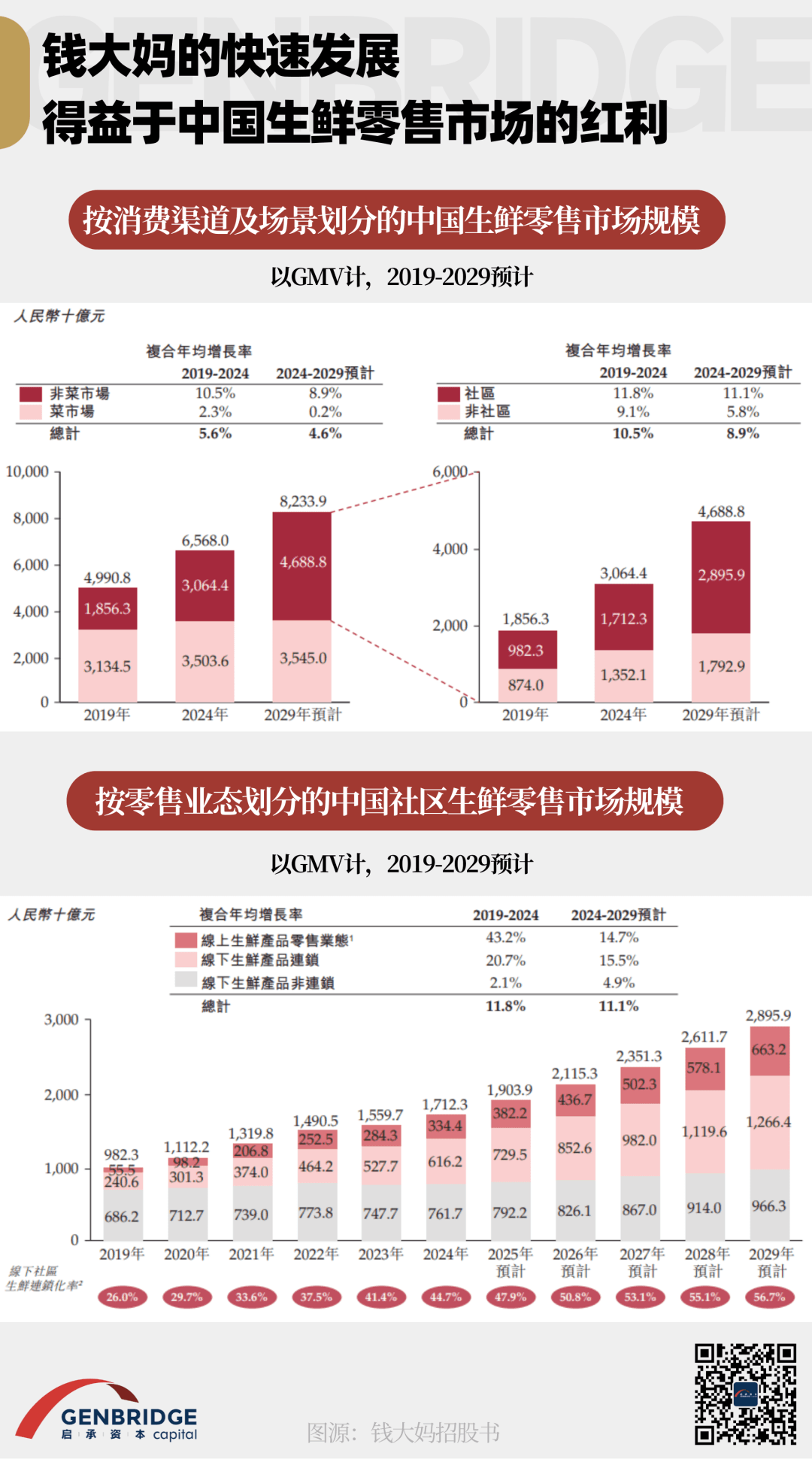

Significant upside remains in community fresh retail

Qiandama’s growth has benefited from favorable dynamics in China’s fresh food retail market.

As one of the fastest-recovering essential consumer categories post-pandemic, the fresh food retail market has reached a scale of RMB 5 trillion and is expected to maintain steady growth of approximately 5% over the next five years.

Wet markets remain the primary channel for fresh food purchases in China. However, due to inherent limitations in product quality, assortment breadth, price competitiveness, and shopping convenience, their market share is gradually being eroded by other channels. Among non–wet market channels, 60% of fresh food transactions occur in community-based scenarios.

Due to the nature of fresh food categories—wide variety, sensitivity to freshness, and personalized demand—offline channels allow core consumers to directly assess quality and select products that match their preferences. This experiential advantage is difficult for online channels to replicate. Offline channels continue to dominate with an 80% market share.

Notably, offline community fresh retail still includes a large number of non-chain, mom-and-pop stores. In 2024, the industry’s chain penetration rate stood at 44.7%, and is expected to rise to 56.7% by 2029, offering significant consolidation opportunities for leading chain brands.

From 2019 to 2024, the community fresh retail chain sector achieved a CAGR of 20.7%, and is projected to continue growing at a CAGR of 15.5% over the next five years. Qiandama is clearly positioned on a high-growth track.

Building on this, according to a retail consumer survey by Boston Consulting Group, China’s fresh grocery sector exhibits five major trends that align closely with Qiandama’s business model:

First, consumers prioritize “freshness” and “value for money” when purchasing fresh food. Nearly 60% cite these as core decision factors, directly matching Qiandama’s value proposition.

Second, demand for “ultra-essential” categories such as pork remains resilient. Over the past five years, per capita consumption growth has significantly outpaced overall protein categories—precisely aligning with Qiandama’s core assortment.

Third, retail channels are shifting from “far-field” to “near-field.” Community fresh retail and discount formats are growing at over 15%, far exceeding the overall retail industry growth rate of 5%. Rooted in medium-to-large residential communities within a 500-meter walking radius of target consumers, Qiandama’s site selection strategy precisely captures this trend.

Fourth, from a geographic perspective, Central China, Southwest China, and East China are expected to contribute approximately 80% of the growth in China’s middle-class population over the next decade, driving sustained demand for quality fresh food. Qiandama already holds the leading market share in core cities across Central and Southwest China, as well as in Hong Kong and Macau.

Fifth, on the policy front, national initiatives such as rural revitalization, agricultural modernization, and cold-chain logistics support further reduce industry operating costs, creating a favorable environment for Qiandama’s development.

Qiandama’s dual-flywheel business model

Qiandama’s core competitiveness lies in its dual-sided value binding with consumers and franchisees.

For consumers, “freshness” at Qiandama is far more than a slogan. According to the prospectus, the majority of fresh products turn over within comprehensive warehouses in no more than 12 hours. Key pork products reach stores within six to eight hours from slaughterhouses—significantly faster than the industry average of two to four days cited by CIC Consulting.

In terms of pricing, Qiandama’s core categories are highly competitive. In markets such as Wuhan, prices of fresh pork tenderloin and eggs are generally lower than those of competitors, delivering tangible value to price-sensitive households. On the foundation of high-frequency essential categories, Qiandama has also expanded into higher-margin short-shelf-life products such as baked goods, as well as 3R products (ready-to-cook, ready-to-heat, ready-to-eat) designed for convenience and younger consumers’ preferences.

As of September 30, 2025, Qiandama had accumulated over 28 million members. In the first three quarters, members shopped more than five times per month on average, significantly higher than the industry average of three times.

For franchisees, Qiandama has built a franchise-friendly entrepreneurship system. Leveraging decades of accumulated experience, headquarters provides nine categories of support covering site selection, product assortment, and pricing and promotions. Tiered training spans all roles from franchisees to store staff, with regional supervisors providing hands-on support after store openings and conducting regular operational reviews.

Thanks to the daily clearance discount model, franchisees face lower initial inventory pressure and relatively low upfront investment. Daily sell-through also enables rapid adjustment and optimization of product mix, effectively shortening the ramp-up period for new stores.

Scale effects from increased store density further dilute costs. According to BCG data, in the Changsha market, once store count exceeded 70, average monthly gross profit per store increased by nearly RMB 10,000.

As a result, franchisee profitability has improved. As of September 30, 2025, each franchisee operated an average of 1.7 stores, with many mature stores achieving replicative expansion.

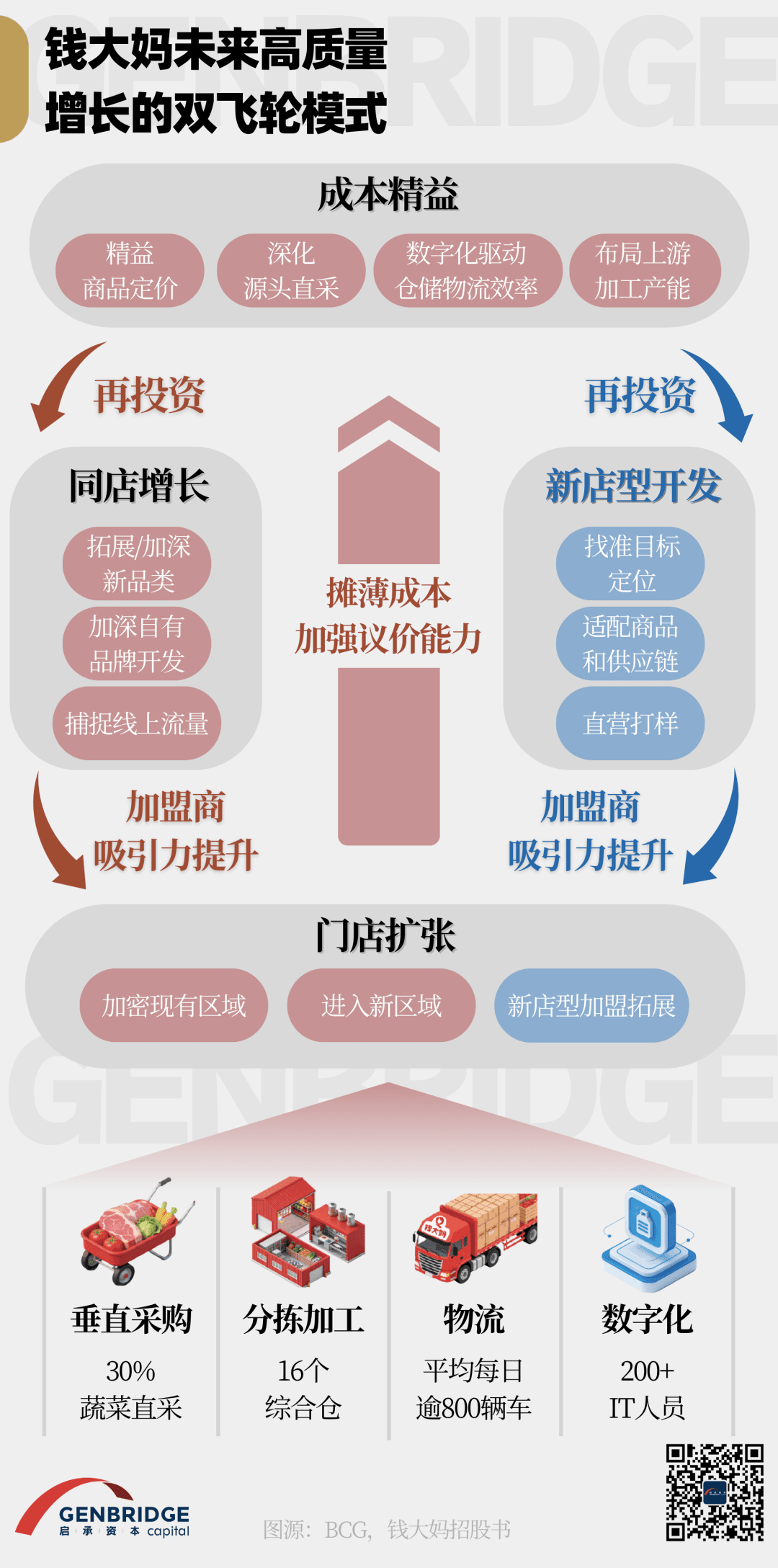

Supporting this dual-sided value system is Qiandama’s long-term investment in supply chain and digitalization.

On the supply chain side, Qiandama operates 16 integrated sorting and processing warehouses nationwide. Through direct sourcing from origins and partnerships with leading suppliers, it ensures freshness while lowering costs, enabling daily fresh deliveries to stores to support the “daily clearance” model.

Digitally, Qiandama has invested continuously over the past decade to build a full-chain system. Intelligent ordering engines optimize replenishment strategies, while outbound management systems control marketing expenses, enabling standardized management across a large store network.

Today, Qiandama has established a “dual-flywheel” growth model:

Starting with cost efficiency through direct sourcing, processing infrastructure, and digital productivity gains, profits are reinvested into new categories, private labels, and online traffic to drive same-store growth; improved same-store profitability attracts more franchisees, fueling store expansion, further diluting costs and strengthening bargaining power, forming a virtuous cycle.

Beyond South China, regions such as Central China and Hong Kong–Macau have built strong brand influence. The Changsha market, leveraging a “mentor-led” franchise strategy and localized assortment, has become a successful model for regional expansion.

From a single community store in Dongguan to a national fresh retail leader with nearly 3,000 stores, Qiandama’s growth is the inevitable result of precise trend recognition, continuous refinement of its business model, and deep cultivation of core capabilities.

As early as a decade ago, GenBridge Capital identified signals that China’s retail sector was entering a buyer-driven era.

We believe that with China’s urbanization and the rise of high-density residential communities, massive traffic and purchasing power have emerged. Against this backdrop, a wave of community-based category specialists has risen.

Distinct categories once housed within traditional hypermarkets have been unbundled into specialized stores—fresh food, frozen food, snacks, convenience stores—meeting residents’ needs for convenience and freshness. Coupled with increasingly mature franchise systems and efficient supply chains, these category specialists possess immense potential for scalable chain expansion.

Qiandama has taken the “meat” category to its extreme.

In traditional channels, balancing freshness and shrinkage has long been a challenge in meat retail. Qiandama innovatively introduced the “never selling overnight meat” principle and adopted a daily clearance approach, setting discounts by time of day. This transformed an industry pain point into a marketing asset, simultaneously addressing consumers’ dual demands for “fresh” and “affordable,” while achieving customer segmentation.

Having witnessed Qiandama’s journey, we are deeply aware of the responsibility behind the title of “No.1 Community Fresh Retail Chain.” Looking ahead, as consumers’ demands for freshness, convenience, and value for money continue to rise, Qiandama is poised for further leaps forward.

With the rollout of the “fresh produce+” large-store format, intensified efforts in the East China market, and deeper integration of online and offline channels, this company—steadfast in its commitment to “freshness”—is well positioned to capture greater share of China’s RMB 5 trillion fresh food market.