What can today’s Chinese F&B industry learn from Saizeriya?

A plate of pasta for 15 yuan, a glass of red wine for 8 yuan… When people think of Saizeriya, words like “great value” and “delicious yet cheap” immediately come to mind. Despite a sluggish consumer market and rising costs across the foodservice industry, Saizeriya has achieved what many would consider a miracle: the cheaper it is, the more profitable it becomes. With consistent year-on-year growth, it now boasts over 2 billion customer visits annually and more than 1,500 stores worldwide.

What’s Saizeriya’s secret to making more money by being cheaper?

In his book The Saizeriya's Management Way 《サイゼリヤ元社長が教える 年間客数2億人の経営術》, former president Issei Horino writes: “Saizeriya is not just an affordable Italian restaurant. Its success lies in its well-integrated system that produces delicious, high-value meals.” There’s no magic at Saizeriya—it’s simply a company that uses technology and intelligence to create results.

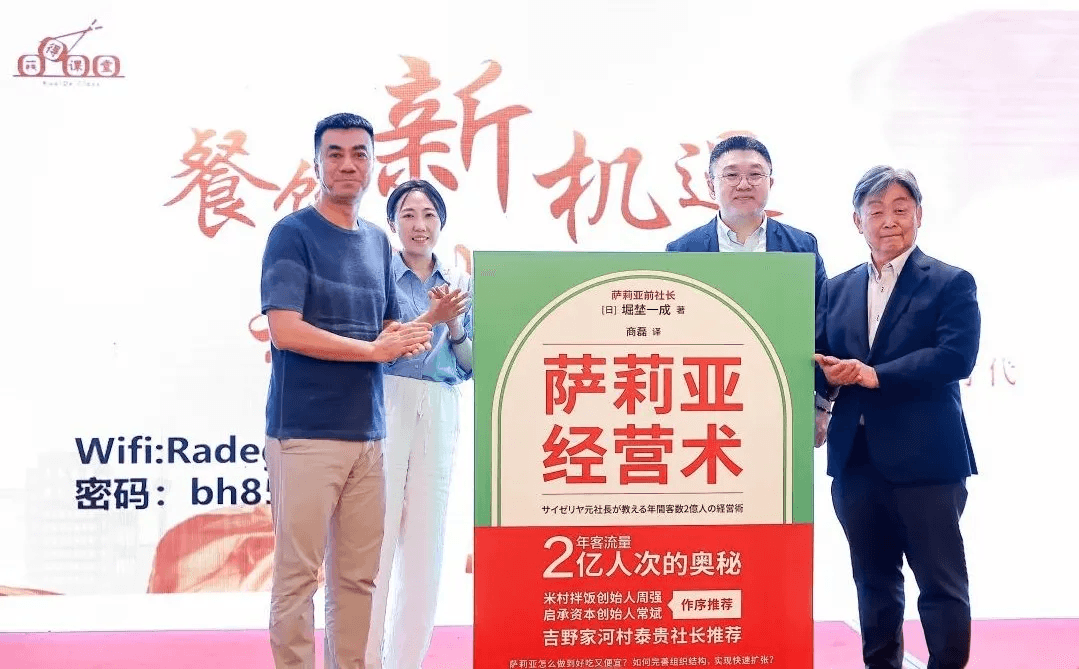

Recently, the Chinese edition of Saizeriya's Management Way《萨莉亚经营术》 was launched in Beijing at a forum co-hosted by GenBridge Capital. Issei Horino attended the event, where he gathered with industry leaders and professionals from China’s F&B sector to discuss the future of chain dining, using Saizeriya as a benchmark.

A graduate of Kyoto University with a master’s degree in agricultural science, Horino first gained experience at Ajinomoto in food industrialization. In 2000, he was invited by Saizeriya’s founder to join the company, where he introduced food science thinking into restaurant operations and helped develop a unique industrialized restaurant model.

In the book, Horino reveals the secrets behind Saizeriya’s legendary affordability. Saizeriya isn’t just a restaurant—it has vertically integrated the entire value chain of services (tertiary industry), manufacturing (secondary), and farming (primary). By controlling costs to the extreme, Saizeriya ensures both quality and taste.

The book details many examples across the supply chain. For instance, to reduce rice costs, Saizeriya began by researching how rice is grown and identified the most expensive part—agricultural machinery (specifically rice hullers). After careful analysis, they adopted a strategy of staggered planting across regions to maximize the use cycle of these machines.

As a result, the price of a bag of rice dropped from 15,000 yen to 10,000 yen, significantly cutting costs and increasing efficiency.

In today’s intensely competitive foodservice sector, Saizeriya’s model serves as a valuable “textbook” for Chinese restaurant operators. As Qiang Zhou, founder of Micun Bibimbap, once said, “Among restaurant brands, Saizeriya is one of the most influential on Mizunomura.”

The significance of Saizeriya in today’s era

In recent years, China’s consumer market—especially the foodservice sector—has been under heavy pressure. Many industry practitioners have personally felt this strain.

Yet, as consumer spending tightens and macro trends shift, Saizeriya has not only grown in China, opening more stores and turning losses into profits—it has even become a key source of the group’s global earnings. For many, this seems incredible.

But in our view, Saizeriya’s success wasn’t sudden. It was inevitable.

In the autumn and winter of 2020, during China’s heightened pandemic controls, we anticipated a major shake-up post-reopening. We believed the restaurant industry would see a surge in chain penetration. Based on this forecast, we turned our attention to Japanese brand Saizeriya.

In recent years, China’s foodservice chains have thrived thanks to widespread shopping malls and residential communities. Most rely on high-volume “hero products.” Saizeriya, by contrast, offers a complete dining solution from appetizers to desserts—an approach we believe better suits the evolving needs of the Chinese market.

From that point on, we dedicated substantial time to researching Saizeriya and interviewed many retired industry experts. As our study deepened, we began to understand Saizeriya’s unique status in Japan’s restaurant scene.

Japan’s foodservice sector has long been considered a “dark continent”—lacking scalable, efficient business models due to its heavy reliance on service labor. Since the 1990s, Japanese household income declined while labor costs surged due to aging and shrinking populations. This dual squeeze of falling demand and rising costs triggered a brutal industry shakeout: from 1996 to 2022, the number of registered restaurant corporations in Japan dropped by over 30%. By 2011, the industry’s size had shrunk by nearly 20% compared to its 1997 peak.

In this grim landscape, Saizeriya’s unbeatable cost-performance ratio proved incredibly powerful. While competitors struggled, Saizeriya expanded aggressively: from the 1990s to 2020, its baked rice dish dropped from 30 yen to 18 yen, and its prosciutto from 36 yen to 18 yen. Meanwhile, store count jumped from 50 to 600 in just a decade. During this period of rapid growth, Saizeriya also faced growing pains. Between 1998 and 2003, the chain added over 100 stores per year, but average store revenue fell from 130 million to 90 million yen. The root cause: insufficient talent pipeline, underdeveloped management systems, and immature supply chains.

Horino joined Saizeriya in 2000 and became president in 2008. Under his leadership, the company transitioned from rough expansion to structured management. His long-term strategy and investments elevated Saizeriya’s development and enabled its successful expansion into China.

In Horino’s view, Saizeriya’s core competitiveness lies in three areas: Low-cost operations; safe, decent-tasting food; a just-right environment and service.

By sticking to these principles, Saizeriya has achieved extraordinary growth even in economic downturns. As of its August 2024 earnings report, Saizeriya recorded revenue of 224.5 billion yen (up 22.5% year-on-year), net profit of 8.1 billion yen (up 58%), and a market cap of 250 billion yen.

Today, Saizeriya operates 1,569 stores globally, including 1,038 in Japan and 531 across China and other Asian regions. The China market alone contributed 66 billion yen in revenue and 80% of group profit—highlighting the competitiveness and commercial value of the Saizeriya model in China.

China’s restaurant industry is entering a new era:

On one hand, supply is saturated—China leads the world in restaurants per capita; on the other hand, consumers are savvier, seeking “quality-to-price” value. The days of reckless expansion and loose operations are over. Only brands that balance user experience with operational efficiency can survive and thrive.

Saizeriya’s experience offers several key lessons for Chinese restaurant operators:

- Continuous iteration and operational optimization

Given the variety and regional complexity of Chinese cuisine, managing staff is a significant challenge. How to standardize non-standard work, improve employee efficiency, and increase job satisfaction? That’s a common pain point.

Saizeriya boosts labor efficiency by constantly refining store operations. For example, by redesigning mops and optimizing cleaning routes, they reduced opening-time cleaning from 60 to 30 minutes. Across thousands of stores, saving 30 minutes per store means huge gains.

- How to cut costs while preserving quality and experience?

In China, prepared foods are controversial. But standardized supply chains are essential for food safety. Consumers reject not standardization per se, but the decline in quality and experience that often comes with it.

In response, Saizeriya’s solution lies in technological innovation—continually streamlining ingredient preparation processes while preserving flavor. For example, Saizeriya originally used dried pasta, which required each store to cook it on schedule using dedicated boiling equipment. This approach was time-consuming and often resulted in inconsistent quality. In 2000, Saizeriya switched to frozen pasta, eliminating the need for in-store boiling equipment. By around 2005, frozen pasta was further upgraded to chilled fresh pasta, simplifying kitchen operations even more while enhancing taste and freshness—striking a balance between efficiency and customer experience.

- Upstream investment and industrial deepening

Saizeriya even innovates at the farming level. For example, standard lettuce yields just 2–3 salads due to its large core. Saizeriya bred its own “Saizeriya No. 18” variety with smaller cores, yielding 5–7 salads per head—boosting value and efficiency.

For today’s Chinese restaurateurs, Saizeriya is a textbook of exceptional value—not only in its pursuit of efficiency and value-for-money, but also in its care for employees and customers alike.

As founder Yasuhiko Shōnobu once said:

“The essence of chain restaurants isn’t to create wildly successful stores, but to create stores with average sales that can still deliver solid profits.”

In an era where everyone is shouting about “just surviving,” that message rings more true than ever.