On January 16, GenBridge partner company Dream Garden submitted its prospectus to the Hong Kong Stock Exchange.

Founded in Shandong in 2010, Dream Garden focuses on the R&D and application of floral and botanical ingredients, spanning three core areas—body, hair, and facial cleansing and care. It is a leading Chinese skin and personal care brand built around the core philosophy of “以花悦肤”.

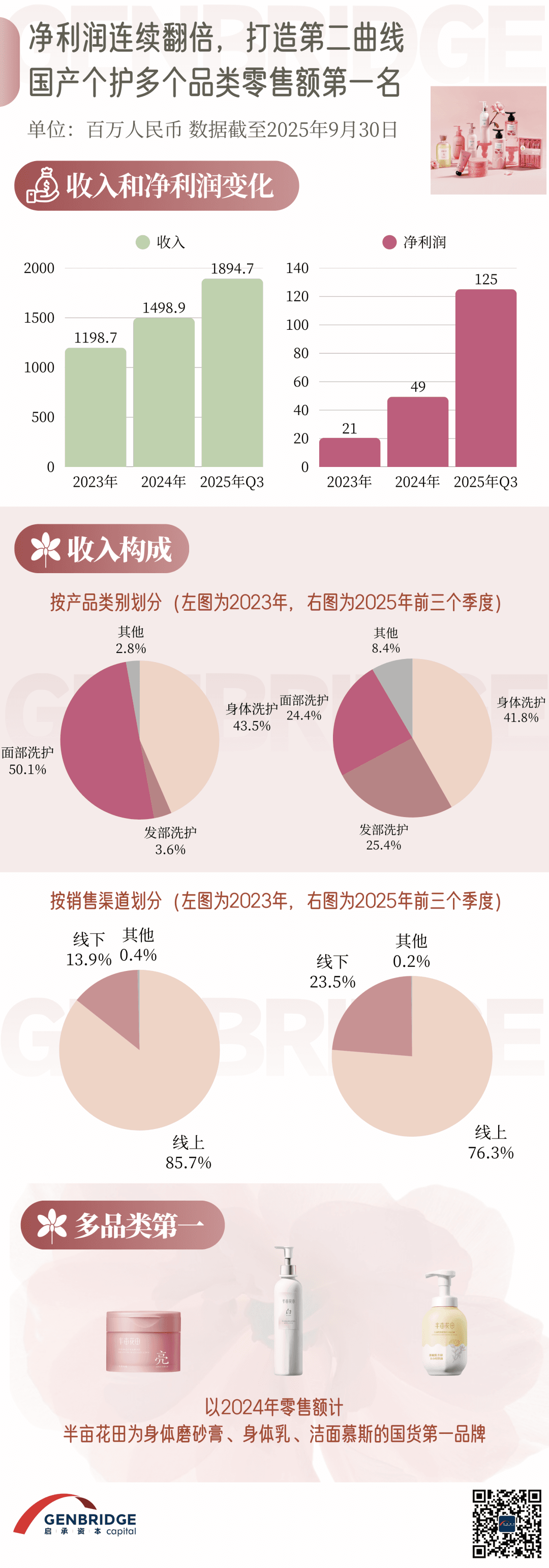

According to the prospectus, Dream Garden’s revenue increased from RMB 1.199 billion in 2023 to RMB 1.499 billion in 2024. Revenue for the first nine months of 2025 reached RMB 1.895 billion, representing a year-on-year increase of 76.7%. Adjusted net profit was RMB 82.83 million in 2024, and rose rapidly to RMB 148 million in the first nine months of 2025.

According to Frost & Sullivan, in 2024 by retail sales, Dream Garden ranked No.1 among domestic brands across three categories—body lotion, body scrub, and facial cleansing mousse. Its overall body care business also ranked among the top ten nationally, with the fastest growth rate among the top ten brands.

From a single floral-botanical care product to a multi-category skin and personal care solutions provider, and from deep online focus to an omnichannel footprint, Dream Garden has stood out in a highly competitive market through clear strategic positioning, sustained R&D innovation, and an efficient operating system.

We believe that with continued increases in R&D investment, ongoing expansion of its category and channel matrix, and the gradual opening of international markets, Dream Garden is well positioned to achieve even greater progress amid the rising wave of domestic brands.

Background: The rising wave of domestic brands

In recent years, the consumer sector has seen a strong wave of domestic-brand momentum—driven on one hand by younger consumers’ cultural confidence and emotional resonance, and supported on the other by a broad uplift in China’s supply chain and product R&D capabilities. Together, these forces have created a historic shift in China’s consumption landscape—from foreign-brand dominance to local-brand rise.

At the same time, the rapid development of online platforms has created the conditions for domestic brands to emerge. With years of deep understanding of consumer needs, domestic brands have flexibly leveraged diversified, emerging marketing channels to quickly build awareness and achieve rapid growth.

Within this wave of import substitution and domestic-brand ascent, Dream Garden stands out as a leading performer.

In 2010, Dream Garden was founded in Jinan, Shandong—known as the “hometown of roses”—and entered personal care through rose hydrosol. It is one of the few domestic brands that started from the ingredient end and has continued to build deeply over time. In 2012, the brand launched its first body lotion; in 2015, it launched its first body scrub product.

In 2018, Dream Garden established a supply chain center in Guangzhou to strengthen supply chain integration capabilities. In 2019, it launched its first cleansing mousse product—rice-ferment amino acid facial cleansing mousse—and began engaging brand ambassadors to enhance awareness.

In 2021, Dream Garden set up a raw-material processing plant in Jinan, established a product development center in Shanghai, and built a high-standard formulation and efficacy testing center in Guangzhou. In the same year, the brand began entering offline channels.

In 2023, the brand launched the first-generation brightening body lotion series. In 2024, Dream Garden’s cleansing products ranked No.1 on Douyin’s 618 Body Cleansing & Care category chart. In 2025, the brand introduced a new flagship product line: the 鲜花花萃 series shampoos.

To date, Dream Garden has continuously upgraded its R&D system and supply chain capabilities, gradually forming a multi-category matrix across cleansing, care, and bathing. As of the first nine months of 2025, the company’s product portfolio had reached 509 major SKUs, creating a product ecosystem in which multiple categories reinforce one another.

It has both rooted downward—strengthening its foundations in ingredients, R&D, and products—and grown outward—continually renewing itself in step with changes in consumers and channels. Throughout its growth, Dream Garden has consistently focused on building long-term capabilities.

Channels: Built online, penetrating offline

In recent years, China’s consumer channel landscape has undergone dramatic change, with content-driven e-commerce rising rapidly online. Brands no longer rely primarily on traditional advertising to drive growth, but instead build awareness and convert sales within content communities.

As a representative domestic beauty and personal care brand that has risen in recent years, Dream Garden’s rapid growth is inseparable from its sharp read on channel trends:

1)Built online, leveraged content to go viral quickly, and completed both brand momentum accumulation and product system build-out;

At the start, Dream Garden chose to enter through online e-commerce. In 2018, it seized the rise of Xiaohongshu, fully leveraging word-of-mouth effects within content communities to acquire its first group of loyal followers at low cost—laying the foundation for subsequent high-speed growth;

It then keenly captured the wave of Douyin short videos and live-streaming e-commerce. In 2019, the brand stepped up content spending and influencer collaborations, and rapidly rose as an industry dark horse through Douyin e-commerce.

2)Expanded into offline channels, driving coordinated efforts through “online ignition + offline penetration”

After securing its position online, Dream Garden proactively extended offline. Since 2021, the brand has built out its offline physical channel network, now covering 31 provinces nationwide and more than 50,000 points of sale. Offline revenue increased from RMB 167 million in 2023 to RMB 356 million in 2024, representing growth of 112.7%.

Deep online–offline synergy has enabled scaled reach while strengthening brand recognition through scenario-based experiences, forming a virtuous cycle of “online traffic generation + offline conversion.”

Products: Natural + fragrance, blending efficacy and emotion

Adhering to its “beauty inspired by flowers” brand philosophy, Dream Garden emphasizes that the natural vitality and beauty inherent in flowers can be translated into products that are both efficacious and emotionally resonant.

Reportedly, Dream Garden views fragrance as an important part of the efficacy experience. By combining advanced fragrance design with sensory science, the company captures natural floral aromas through technologies such as headspace extraction, and translates them into product experiences with strong memorability and emotional value.

With "origin of flowers, efficacy of flowers and pleasure of flowers" as its core R&D philosophy, Dream Garden embeds this framework throughout the entire process of product innovation and development. “Origin of flowers” represents strict control at the source; “efficacy of flowers” focuses on converting floral-botanical efficacy into measurable consumer value; and “pleasure of flowers” integrates advanced fragrance design and sensory science to translate it into product experiences that evoke emotional resonance.

Specifically, on the ingredient side, it adopts a vertical supply chain to address industry “chokepoint” constraints. To ensure product quality, Dream Garden has long-term partnerships with multiple ingredient plantations in Shandong, Yunnan, and other regions, and through the deployment of ingredient processing facilities, strengthens its quality barriers from the source—laying a solid foundation for the brand’s growth.

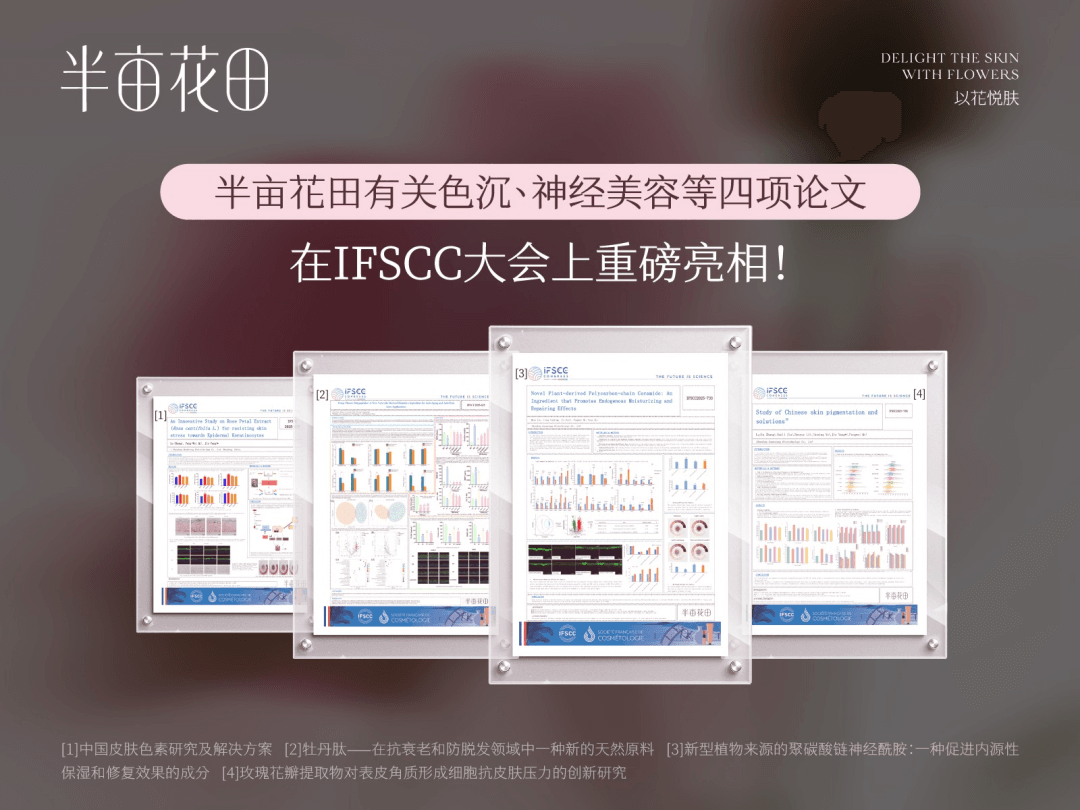

On the R&D front, it deepens research breadth and depth, with a patent system that drives technological defensibility. Relying on a collaborative network of R&D centers in Jinan, Shanghai, and Guangzhou, Dream Garden has formed a full-chain R&D system spanning “ingredient development—basic research—technology translation—product implementation—efficacy validation.” As of September 30, 2025, its R&D team comprised 61 members with diverse backgrounds including botany, biology, dermatology, and applied chemistry, with more than 70% holding master’s degrees or above.

Leveraging Eastern botanical research, its proprietary ingredient processing facilities, and foundational technology breakthroughs, Dream Garden has further strengthened its differentiation by developing proprietary ingredients and technologies such as FloaferMin (an active complex derived from floral botanicals) and RIVETOR PRO repair technology, among others. These are applied across multiple product lines through a standardized efficacy evaluation system, enabling the commercialization and implementation of R&D.

Categories: Moving from “shallow-sea” to “deep-sea” categories

Dream Garden adheres to a product strategy anchored in flagship products and extended through a disciplined multi-category product portfolio

Starting with rose floral water in its early days, and later becoming a leading brand in categories such as body scrubs and body lotions, it gradually achieved full-scenario coverage in body care and then extended into high-growth tracks such as hair cleansing and care—demonstrating a core capability to migrate from shallow-sea categories to deep-sea categories.

From 2010 to 2015, the first five years of entrepreneurship marked Dream Garden’s shallow-sea positioning phase, during which the brand established niche labels through single-point breakthroughs and formed early brand memory anchors.

Dream Garden continued to build deeply and, during this period, successively developed products such as the ice-cream textured body scrub and body lotion. Among them, the scrub differentiated itself through texture, scent, and immediate efficacy, becoming a phenomenon product with annual sales exceeding ten million bottles.

To date, Dream Garden’s body scrubs have achieved cumulative sales of over 37.7 million bottles, ranking second nationwide by retail sales in 2024 and first among domestic brands; body lotions have reached cumulative sales of 56.9 million bottles, likewise holding the top position among domestic brands.

On this foundation, the brand successfully expanded into other categories: in hair care, the fresh floral extracts shampoo series became a core growth driver; in facial care, rice-ferment amino acid facial ceansing mousse fueled steady category growth, ranking second nationwide by retail sales in 2024 and first among domestic brands.

With body care as its foundation, Dream Garden has gradually built a complete product matrix spanning body, hair, and facial care.

Powered by a systematic product development capability, Dream Garden has built a steady development path of 「focus – validate – replicate – scale」—namely, 「flagship-product-led, multi-category product strategy」. It first concentrates resources to a single flagship product and quickly establish market recognition; then validates the development process and market feasibility of the hero product; next replicates successful experience into related categories; and ultimately achieves strategic expansion of the category matrix. This path both controls early trial-and-error costs and, through a replicable hero-product model, lays a solid foundation for sustained growth.

Opportunity: Consumption upgrade for the mass market

Data shows that in 2025, at least 80% of growth in China’s FMCG market was contributed by consumers in tier-3 to tier-5 cities. Under the trend of “cultural confidence and the rise of domestic brands,” more and more everyday consumers are able to spend less while purchasing higher-quality products—living a lifestyle with stronger value for money.

GenBridge Capital believes this represents a new blue ocean in China consumption—and the biggest opportunity for brands.

Specifically, the emergence of this new blue ocean market is accompanied by several trends:

- Rise of local brands: As China’s advantages in supply chain, channel efficiency, and people-management costs become increasingly evident, local brands have the opportunity to compete with international brands in the mid-price segment by creating products with strong value for money;

- Product innovation: Shifting from technology-led to customer-led approaches, uncovering deeper user needs across scenarios and emotions, completing an upgrade from “Have to Do,” and opening up new categories;

- Consumption upgrade alongside rationality: While pursuing quality, consumers are increasingly value-conscious, creating opportunities for companies to meet needs across different tiers.

Dream Garden’s rapid development is precisely the result of capturing such opportunities.

Taking the hair cleansing and care industry as an example, traditional major brands iterate slowly and focus on basic cleansing, while consumer needs have upgraded from “cleansing” to “specialized benefits” (such as brightening, oil control, and volumizing) and “emotional value” (fragrance and experience). Centered on “flowers,” Dream Garden highlights “natural ingredients + fragrance experience,” filling a gap in the market for the dual demand of “efficacy + emotion.”

According to Frost & Sullivan, by retail sales, China’s hair cleansing and care market was approximately RMB 112.1 billion in 2024 and is expected to grow to RMB 151.0 billion by 2029 at a CAGR of 6.1%. While overall category growth is relatively steady, as people increasingly prioritize quality living, consumers are gradually extending skincare mindsets into hair cleansing and care.

The facial care space is showing a similar trend. Consumer demand for facial cleansing products is becoming more diversified and refined, with a preference for high-quality products that combine gentleness and efficacy. According to Sullivan, China’s facial cleansing market is expected to grow further at a CAGR of 7.4%, reaching RMB 522.1 billion by 2029.

Within a steadily developing market, opportunities to overtake on the curve come from capturing new demand and innovating products. Dream Garden is skilled at finding opportunities in overlooked customer needs, establishing positions in shallow-sea categories, and gradually migrating into deep-sea categories.

Looking ahead, GenBridge Capital believes that under the strategy of “hero product leadership and full-category expansion,” supported by a consumer-centric integrated product development and management system, Dream Garden will continue expanding its product lines to meet evolving consumer needs—and bring the power of China’s natural floral and botanical ingredients to the world.