This article is adapted from the speech delivered by Robert Chang, Founder of GenBridge Capital, at 2025 Portfolios Gathering.

This year, perceptions of the consumer sector have diverged: some feel a recovery is underway, while others believe the winter remains harsh. Why this discrepancy?

To find an answer, we reviewed the financial reports of dozens of consumer companies and discovered that both realities coexist.

The bad news: nearly half of consumer companies are experiencing revenue decline. Even in essential categories like food, a 5% drop is already considered strong performance, while many companies have fallen 10–20%. The overall industry landscape is severe.

The good news: despite this, a number of companies have withstood the pressure and continued to grow, even thriving against the trend.

To understand how these companies achieved such resilience, we analyzed their reports in depth. We found that they share one underlying insight—the fundamental driver of growth has shifted to products and users.

Let’s examine a few examples.

Who is growing against the trend — and what are they doing right?

The first example is a familiar name: Nongfu Spring.

In the first half of 2025, Nongfu Spring’s tea beverage revenue exceeded RMB 10 billion, accounting for nearly 40% of total revenue and surpassing packaged water to become its largest category.

This is driven largely by the success of its Oriental Leaf series, which has achieved a compound annual growth rate of over 90% in the past three years, firmly dominating the unsweetened tea market.

Yet ten years ago, Oriental Leaf was voted by netizens as “the most difficult drink ever.” According to Shanshan Zhong on CCTV’s Dialogue, the product lost money for six to seven consecutive years.

How did it go from “worst tasting” to market leader?

The truth is: the product didn’t change — consumer demand did.

Reports from Kantar and Nielsen show that over 70% of young consumers consciously reduce sugar intake, and nearly 60% are willing to pay a premium for healthier, simpler-ingredient foods. “Bitter” no longer means unpleasant; it signals naturalness and health.

Nongfu Spring anticipated this trend early. Despite years of losses, it patiently invested in R&D, reformulating taste profiles, expanding the product line, scaling production, and building distribution. After a decade of persistence, the category finally took off.

The second example compares two food companies: Weilong and Yanjin Shop Food.

In the first half of 2025, Weilong’s revenue grew 18.5% year over year, with net profit rising 18%. Yanjin Shop Food saw revenue grow 14.67% in the first three quarters, with net profit rising 21.31%. Their results reveal two shared drivers:

1. Konjac has become a high-growth category.

Konjac, a soluble dietary fiber, is viewed as a versatile base in healthy foods. In 2025H1, Weilong’s konjac and seaweed products accounted for 60% of revenue, surpassing noodle-based products. Yanjin Shop Food likewise saw konjac drive its growth, now contributing nearly one-third of revenue — about half of Weilong’s konjac scale.

Where snacks were once viewed as unhealthy, rising health consciousness has shifted consumer expectations toward tasty yet guilt-free options. Weilong and Yanjin Shop Food captured this shift early, pioneering konjac in snacks and redefining the category with lighter and healthier products.

2. Embracing emerging offline channels.

A prime example: Weilong’s co-created konjac–porcini product with Sam’s Club. For consumers, being sold at Sam’s is itself a quality endorsement, elevating Weilong’s brand perception in healthy snacking. Sam’s helped Weilong sell not just konjac—but a more premium, healthier image of Weilong.

Yanjin Shop Food also aggressively expanded into new channels such as Mixue-led bulk snack formats. These channels offer better cost efficiency and margins than e-commerce, now contributing 40–50% of its revenue. Co-created products like “Sesame-Flavored Beef Tripe” have reached RMB 200 million in monthly sales.

Today’s emerging channels function not just as sales platforms but as front-end laboratories for product innovation, setting new benchmarks in quality, communication, and consumer experience.

The biggest retail shift in recent years has been the decline of “seller-driven markets” and the rise of “buyer-driven markets.” Seller-driven markets rely on price subsidies—traditional supermarkets and even JD/Tmall fall into this category.

Buyer-driven markets prioritize user value. From Sam’s Club and Hema to bulk snack stores and Douyin, these channels focus less on price competition and more on content- and product-driven attraction.

These cases show that companies achieving growth today are those who have adopted the “buyer-side framework”—breaking from seller thinking and prioritizing users and products. These are the companies winning the stock-era competition.

Nongfu Spring persisted for years with patience and conviction, studying consumer trends and refining its products—allowing Oriental Leaf to finally be recognized.

Weilong and Yanjin Shop Food likewise embraced consumer shifts and collaborated openly with channels to co-create strong products, unlocking meaningful second-curve growth.

Their countercyclical growth proves: today, the starting point of business breakthrough is the user, and the vehicle is the product.

The origin is the user, the vehicle is the product

“User-centricity” is not a new concept in consumer markets, yet truly achieving it is difficult. Many brands claim to meet consumer needs but still produce homogeneous, copycat products. Everyone talks about adding emotional value, but beyond IP licensing and collaborations, what else can brands do?

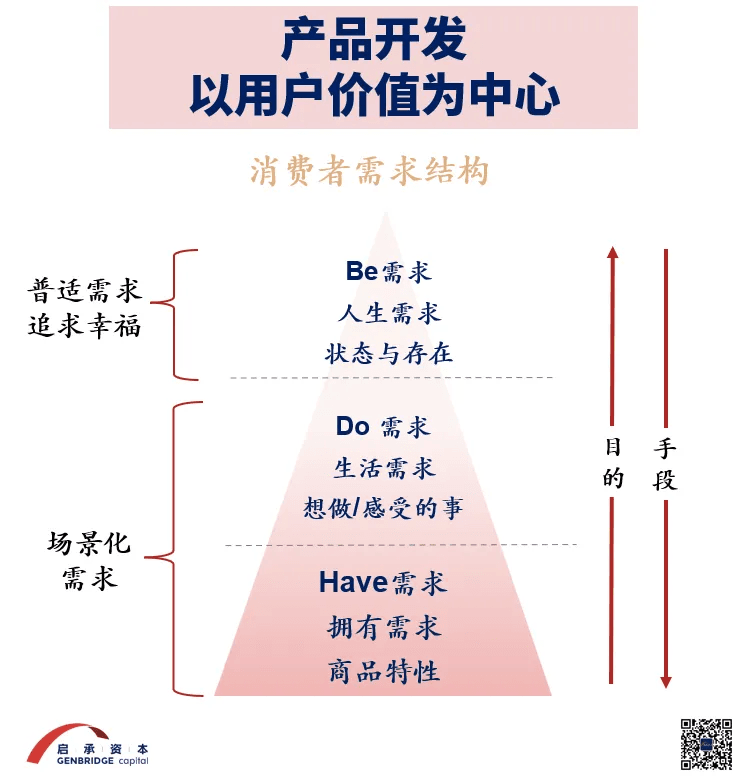

For this, we use a powerful framework—the “Be-Do-Have” model. Originally from personal development and rooted in psychological theory, it is now widely applied in product development and business analysis.

It breaks user needs into three layers:

• HAVE: The level of possession—what the user needs to have (the product itself).

• DO: The level of action—usage scenarios and experiences.

• BE: The level of identity—who the user wants to become, a universal aspiration for self-realization.

In product development, “HAVE” represents traditional logic: functional benefits and price efficiency. “DO” focuses on contextual needs—the dominant approach today. “BE” is the highest level—suggesting who the consumer becomes through the product.

A brand competing only at the “HAVE” level inevitably falls into price and functionality battles. But exploring “DO” (experience) and “BE” (identity) unlocks completely new pathways.

Many GenBridge portfolio companies have already begun this exploration.

Take Yeswood: in 2024 it exceeded RMB 10 billion in revenue and is still growing over 50% this year.

Early on, Yeswood positioned itself as an affordable solid-wood furniture brand, selling primarily on Tmall and JD. By removing intermediaries, it offered 1.8m solid wood beds for RMB 1,000—cheaper than IKEA particleboard beds. It perfectly satisfied “HAVE-level” demand for affordable solid wood furniture.

But it didn’t stop there. Yeswood expanded into “DO-level” needs—real-life usage scenarios.

Its products integrate deeply with daily life—beds that store and light, nightstands with charging and voice activation, movable vanity tables, etc.

Since 2015, Yeswood expanded offline and now operates over 1,200 stores, allowing consumers to experience the aesthetics and texture of solid wood physically.

Beyond oak, it introduced higher-end cherry wood and walnut series. Price bands have risen to around RMB 10,000 while retaining value-for-money—clear evidence of rising brand equity.

In recent years, Yeswood has also moved into the “BE” level—tapping into users’ identity aspirations.

Recently, the film Her Story won Best Picture at the Golden Rooster Awards. The film, centered on modern female solidarity, features home interiors fully furnished by Yeswood.

Through this partnership, the brand conveys a lifestyle of independence and confidence, resonating with young women’s aspirations for strength, courage, and self-love—aligning Yeswood’s values with their identity. This reflects its evolving brand narrative: “Living with wood, creating a better life.”

Beyond Yeswood, many GenBridge portfolio companies are pursuing similar differentiated strategies:

Shiyue Daotian began with packaged rice but built a second growth curve through corn products. Aligning corn with themes of health, discipline, and beauty tapped into consumer aspirations for self-improvement. As of June 30, 2025, corn contributed RMB 433 million in revenue—its second-largest category.

Forest Cabin leveraged distinct product strength to evolve from “affordable alternative to global brands” to a leader of “national brand confidence.” Its new “Little Gold Pearl” achieved RMB 7 million GMV on launch day. During Double 11, it ranked #1 on Douyin in both Toner and Facial Oil categories—a rare dual-category dominance for a Chinese brand.

As the market shifts from seller-driven to buyer-driven, companies that deeply explore multi-level user needs and design targeted products will secure category leadership. Through continuous iteration, they shift from functional value to emotional value—positioning themselves to win the next 20 years.

When growth dividends fade, the industry needs clearer insight and sustainable product capabilities. Trends change, channels change—but user value does not. Future competition will not favor the loudest or the fastest—but those who best understand users and build products that are truly needed.

In a saturation era, this will be the ultimate source of all growth.