The theme of today’s event, “Tribute to the Runners,” is especially fitting — entrepreneurs are constantly running forward. For entrepreneurs, choosing to run and choosing where to go are equally important. I believe everyone here today is looking for direction. So, I’d like to share some reflections and insights from GenBridge Capital over the past year, in the hope they may offer some inspiration.

Let me first introduce GenBridge Capital. Our vision is to empower the “next generation of consumer champions in China.” We focus on the growth stage and strive to identify and accelerate the expansion of companies by adhering to our core principle of “providing value beyond investment”. Our goal is to help companies proactively generate growth and benefit alongside them through that growth.

What sets our investment philosophy apart is our persistent effort to uncover opportunities in the mass essential consumption market. Over the years, we’ve invested in a number of outstanding consumer companies based on two central themes: new generation of national brands and new generation of national chains.

What has actually changed in the consumer market over the past year?

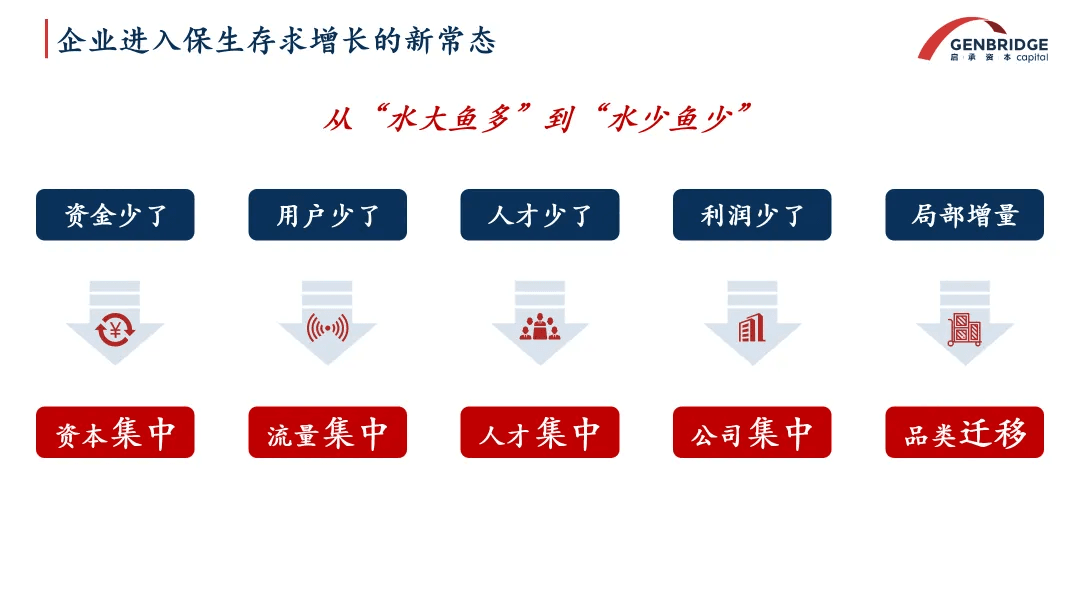

Enterprises have shifted into a new normal: surviving first, then seeking growth

Let’s start by looking at the market environment. We’ve moved from a market of “plentiful water and abundant fish” to one where “the water is drying up, and fish are few.” This is a harsh but real truth — one we must acknowledge and confront.

- Less capital available

In 2023, there were just over 600 investment deals in the primary consumer market, with total funding around 30 billion RMB — nearly a 50% drop compared to 2022. A large amount of capital has exited the consumer sector.

Nearly half of the companies that received funding were at the startup stage. This means that capital allocated to mid-to-late-stage growth companies has largely left the space — in part due to limited exit channels under current policies.

As a result, capital is increasingly concentrated in ultra-large funds or among firms who have chosen to stay the course. These investors have raised the bar, and that creates a greater challenge for companies that haven’t yet developed a distinct competitive advantage.

For decades, financial leverage has been a major driver of enterprise growth. But now, deleveraging has begun. Entrepreneurs must be prepared with ample self-funded reserves.

- Fewer active users

We analyzed online growth data across 30+ consumer categories. Nearly 10 showed no growth or even decline; a dozen or so grew by just 0–10%, and only a few exceeded 10% growth.

E-commerce has been the key engine behind China’s consumer market growth in recent years. Once that engine stalls, the overall market shrinks.

Traffic and users will increasingly concentrate around brands with strong operational capabilities and platforms that dominate user attention. This leads to higher traffic costs, which ultimately compress profit margins.

- Less talent available

This isn’t to say there’s a lack of people in the job market, but rather that the number of “just-right” talents for your business has declined.

While there’s a healthy supply of high-quality talent overall, do they truly understand your company's vision and model? Can they build upon that understanding to innovate? That’s the challenge.

If your company has a robust talent acquisition and retention system, this is actually a prime opportunity to upgrade your organization.

- Shrinking profits

Profit contraction may seem like just a financial issue, but it often leads to internal anxiety and strategic confusion. Many companies respond by doubling down on operational efficiency in their existing businesses to protect margins.

However, true profit growth often comes from looking outward, and from actively innovating. Stable profits are a result of strategic exploration and creation.

When profits shrink, companies often lose the will to explore — but those that retreat into low-quality operations and strategic paralysis are bound to be eliminated in this phase.

We’ve entered an era not of absolute growth, but of localized and structural growth. New categories are rare; instead, we’re seeing intra-category migration. Many of our portfolio companies have benefited from these shifts:

Harvest seized the trend of packaging and online retail in rice; Yeswood capitalized on the rise of health-conscious furniture and direct sales channels; Ripe Fruit leveraged sugar-free vs. sugary snack substitution trend.

Previously, consumer opportunities were like floodwaters — they poured into the market and everyone grew. Now, we’re in the era of tributaries — growth depends on deliberate choice.

If your tributary doesn’t align with where the current is flowing, it may be hard to receive growth dividends. That’s why it’s essential to ask is your product on the new side of the curve, or still stuck on the old side?

Because product innovation is the root of all growth.

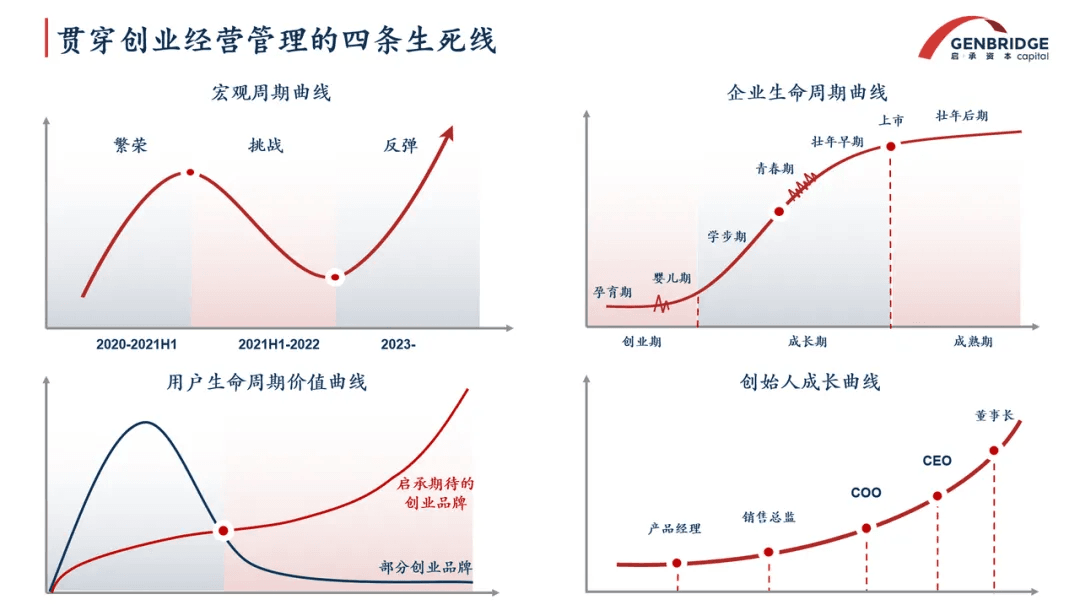

The four life-or-death curves in entrepreneurship and operation management

How should we respond to the current environment?

The foundation of finding direction is first recognizing where you stand. Only with a clear understanding of our current situation can we maintain realistic optimism. There are four key curves that can help companies locate themselves and assess where they are — each curve essentially determines a business’s future momentum, potential energy, and long-term profitability.

- The macro cycle curve

No one can accurately predict where the macro economy is headed — and that’s not the point. What matters is accepting it, and even enduring it.

First, recognize that business growth doesn’t follow a straight line; spiral growth is good enough.

Second, in a difficult environment, complain less — instead, pause and focus on internal capabilities.

Third, cultivate a habit of “watching the market”: continually assess where your company and industry are in the cycle, gather market data, and refine your judgment to guide decisions.

- The business lifecycle curve

The lifecycle of a business largely depends on three “distances”: between decision-making and the founder, between decision-making and market competition; between decision-making and the end user.

Early-stage startups often benefit from high decision efficiency because founders are close to the action. But as a company grows, being too close may actually hinder development. This is a dynamic and evolving process, and must be adjusted constantly as the business scales.

- The user lifecycle curve

In the last cycle, many companies received financing and spent 99.9% of it on user acquisition, quickly gaining a flood of new users — represented by this blue user lifecycle curve. At that point, companies thought they had discovered a new continent. But in reality, they had paid dearly for fake demand and fake users.

Many assumed that acquiring users at a loss would lead to repeat purchases. But they later found re-purchase was never guaranteed — especially in fast-moving consumer goods (FMCG), where loyalty is low.

Users need to be filtered and re-engaged continuously. We place higher value on stable, gradual user lifecycle growth: Start by cultivating a strong core user base,then gradually expand the circle. In the end, repeat purchase behavior determines the true size of a company’s profits — and it can only be driven by ongoing product iteration and efficient user acquisition. Without that, even if your business becomes large, it remains big but weak.

- The founder growth curve

Many founders start out essentially as product managers. Later, they find sales channels and transition into sales directors.

As the company grows further, they realize the business requires HR, finance, and system building — leading them to become general managers or COOs, managing across functions and departments to boost efficiency.

When founders step away from daily operations to think strategically and manage external resources, they evolve into true CEOs. Eventually, when they’re capable of appointing and empowering a CEO, making decade-long strategic decisions and resource allocations — they become chairpersons.

A founder’s responsibilities are more than a title on a business card.

Some founders play chairman roles too early — distancing themselves from products, sales, and daily management.

Others, even as the company scales, cling to being product manager or sales director — which stalls the building of a talent pipeline.

Both types of situations require serious reflection and course correction.

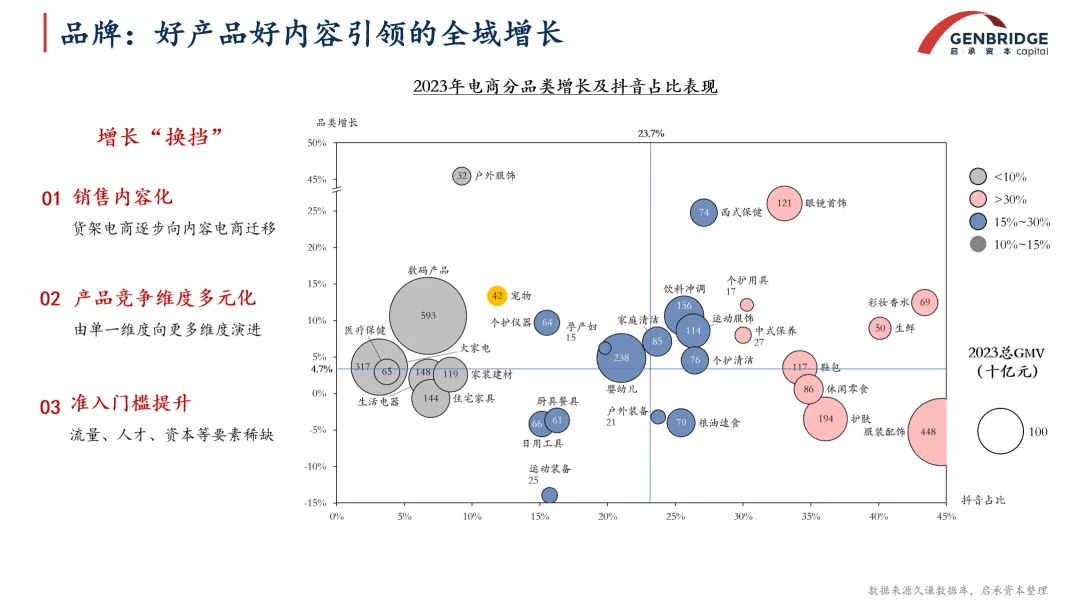

Full-funnel growth driven by great products and content

So how do we drive sustainable enterprise growth?

Future growth will be powered by the combination of strong products and compelling content, driving full-funnel, omnichannel growth. Our analysis of last year’s e-commerce data shows that growth has shifted from shelf-driven and keyword-search-driven models to content-driven growth. Shelf-based e-commerce is migrating toward content e-commerce. Brands that fail to tap into platforms like TikTok risk falling behind.

At the same time, product competition is becoming more multidimensional. It’s no longer enough to explain features, attributes, and pricing through images and text. Products must now be multi-sensory and scenario-specific. They need to align with your brand’s tone and storytelling, and engage users through effective dialogue. This raises the entry barriers for many brands.

China’s channel structure can be visualized as a pyramid. The more surface area you can cover, the larger your potential growth.

At the top of the pyramid, you have online DTC channels like flagship stores. These are relatively stable — not driven purely by traffic. Many users come searching for your brand or product category, and these channels are a major source of profit.

However, this model is being disrupted: price comparisons are now universal across platforms, so brands must standardize pricing across all touchpoints.

Content e-commerce is becoming the main engine for generating future traffic. If your company lacks content operation capabilities, you may miss out on surplus traffic spillover and future visibility.

O2O channels (community group buying, dark stores, etc.) act as bridges from online to offline — helping your brand reach physical touchpoints. But this demands a complete overhaul of your product lineup — adjusting format, pricing, and margins to fit very different consumption scenarios and audience profiles.

Beyond the domestic pyramid, Chinese brands are now entering a new era of global expansion. The last wave of outbound growth was mostly channel-driven: Chinese brands supplying local retailers — effectively becoming channel brands. But now, content e-commerce has gone global. Brands can now tell their story directly to global consumers — through values, positioning, and richer product systems. One example is ZH Plant Protection, a portfolio company of ours. Its products are now sold in Africa and are very popular in Southeast Asia — showing that there's huge untapped potential overseas.

Take Botare as an example — the brand started out selling basic tissue paper. During the era of shelf-based e-commerce, it relied on extreme cost-performance to secure high-traffic product placements and drive sales. But in the content e-commerce era, Botare made a major transformation: it diversified its packaging into various formats and colors. While this may sound trivial, in a content-driven context, anything that can carry "visual storytelling" becomes a sales opportunity. On this foundation, Botare further innovated with a hanging tissue pack, allowing tissues to be hung on walls as part of home decor. This product alone quickly surpassed 100 million RMB in monthly sales, with demand consistently outpacing supply. Many competitors attempted to replicate the idea, but Botare had already pioneered a billion-level new product category, driven by great products and great content.

Content e-commerce is not only a low-cost channel for product testing, but also helps brands set smarter pricing structures. Since brands must reserve a substantial budget to cover traffic acquisition costs, they need to justify premiums to users — encouraging better product development in the process.

This pricing flexibility also makes it easier to extend across offline and distribution channels. Previously, Botare had difficulty expanding offline. But with new product categories, pricing tiers, and margins, it now has the room to distribute across broader channels, making offline growth possible.

Brands that emerge from platforms like TikTok tend to have much clearer and sharper selling points compared to the shelf-e-commerce era. In the past, a product on a shelf might just show a static image with a long scrollable product detail page. Now, short videos must convey the core selling point in seconds.

This forces companies to constantly refine their product messaging:

What’s the unique value proposition?

Who exactly is the target user?

What is the most compelling way to communicate it?

This process trains the brand to build a strong mental position in the user’s mind.

Livestreaming isn't just someone shouting into a camera — it’s an end-to-end marketing system and brand narrative. It builds daily, cyclical engagement with core users, presenting and reinforcing the brand story. This direct-to-user channel also creates a rapid feedback loop within the organization. If sales dip, the team can immediately analyze whether it was the wrong messaging, wrong audience, or ineffective content. A strong operations team will quickly iterate and adjust. Over time, the brand gains deeper insight into what actually drives sales.

Make no mistake — content e-commerce is 10x harder to manage than traditional models. Despite the skepticism or misunderstanding some may have about platforms like TikTok, it remains a major engine for traffic and growth. As entrepreneurs, the mindset should be: how to embrace it, how to collaborate, even though the platforms change rapidly. There’s no fixed playbook — success depends on continuous experimentation and an organization that is agile in both decision-making and internal communication. Once you've built a "champion team" within content e-commerce, those operational capabilities will also help you win across other channels.

Cost reduction and efficiency: The must-win battle

Beyond growth, cost reduction and efficiency optimization are the battles that leaders must win today. Above all, the priority is survival. As companies grow, founders often lose touch with their actual cost structures. At GenBridge Capital, we help businesses analyze their operations so founders can regain clarity on cost dynamics and resource efficiency.

Founders must cultivate a deep awareness of cost that permeates the entire organization. Every employee should be encouraged to treat cost management with discipline. Founders should map out the entire supply chain, from production to operations, identifying opportunities to reduce cost. Ultimately, cost reduction is a strategic move, not just a financial one. It frees up resources to double down on future growth areas. What looks like penny-pinching is actually a way to reinvest in value creation.

Today's theme is "High-Quality Growth Under Survival Mode." We hope the cases shared today offer valuable insights and pathways to sustainable growth. Every generation of entrepreneurs faces its own unique historical moment and must find the path that suits them best. And for this generation, that means forging a new road — one that is truly your own.