Many travelers to Japan are inevitably captivated by the dazzling variety of products lining store shelves. “Regional limited” and “seasonal limited” items seem designed to empty your wallet, and shopping guides remain consistently popular across social media. From regional and seasonal exclusives to IP collaboration packaging, a single snack can come in more than a dozen SKUs—inviting consumers to try them one by one.

Macro data show that Japan’s beverage industry launches more than a thousand new products annually, with over 6,000 SKUs available on the market. Convenience stores introduce 50–100 new items every week, and roughly 70% of products are replaced within a year. This constant high-frequency innovation has created a thriving ecosystem rich in both variety and quality.

Consumer innovation did not happen overnight. What evolution has Japanese product development undergone to reach its current state?

In fact, Japanese product development originally started with imitation.

From the 1950s to the 1980s, Japan entered a period of high economic growth. Department stores and supermarkets emerged, and the food manufacturing industry flourished. The consumer market was still in its early stage, with limited product variety and relatively simple development approaches focused primarily on two directions:

- Industrializing traditional Japanese foods into standardized mass products;

- Localizing popular overseas foods to create domestic alternatives.

A classic example of the former is instant noodles: Nissin’s founder, Momofuku Ando, deep-fried ramen and placed it into a paper cup, transforming it into a convenient, standardized, mass-producible food product. The latter is exemplified by Calbee, which brought America’s popular potato chips to Japan, localizing them and filling a gap in the Japanese snack market.

These pioneers re-created already validated products, solving the “from nothing to something” problem—and achieved great success as a result.

However, from the 1980s onward, rising per-capita income, emerging retail formats, and increasingly diverse consumer demands meant that simply copying success was no longer enough. Japanese consumer companies began investing heavily in truly innovative products. Only then did Japan’s consumer society enter a phase of genuine prosperity.

Interestingly, during this stage, Japan did not actually experience significant technological breakthroughs in food science. As economic growth later stagnated, companies also reduced investment in R&D, making it difficult to produce disruptive innovations on the scale of Ajinomoto’s invention of MSG.

Despite this, intense competition continued to generate an astonishing variety of products. This environment gave rise to Japan’s unique product development methodology—approaching product creation from the user’s perspective, thinking about how to recombine existing resources creatively and cost-effectively to satisfy unmet consumer needs.

In this article, we explore how Japan’s user-oriented product development philosophy was formed and how it evolved.

Behind the scenes: Consumer research centers

Around the 1980s, Japan’s consumer market environment underwent significant transformation:

On one hand, economic growth began to slow. From the mid-1970s, Japan’s GDP growth dropped from double digits to moderate levels, and the 1990s saw stagnation following the bursting of the asset bubble. The market shifted from a seller’s market to a buyer’s market.

On the other hand, demographic and societal changes diversified consumer needs. A new generation emerged, pursuing individuality, quality, and emotional fulfillment.

These macro shifts pushed Japanese consumer companies to strengthen user-research capabilities—shifting from passively responding to the market to proactively studying the deeper needs of “seikatsusha,” meaning consumers viewed as complete individuals with lifestyles and value systems.

To adapt, consumer companies undertook organizational and methodological reforms.

First, they established dedicated consumer research centers that regularly published trend reports, conducted in-depth studies on latent consumer needs, and served as internal think tanks. Shiseido’s Consumer Information Center and Kao’s Home Research Institute are representative examples.

Their research subjects were not limited to existing product users—they were also responsible for uncovering latent demand and identifying opportunities for future products. Operating independently from marketing and product development departments, and free from sales-performance pressure, these centers often reported directly to senior management or strategy units, influencing product planning and corporate direction.

Suntory’s global innovation center and sensory testing

Second, companies adopted a wide range of advanced research methods to systematically analyze preferences across different consumer groups, replacing intuition with data-driven models and exploring implicit needs and tacit knowledge through direct observation of daily life.

Among these, nothing demonstrates the rigor of Japanese consumer research better than the sensory-science studies conducted by food and beverage companies.

Take snacks as an example: to understand what consumers truly perceive as “delicious,” researchers conducted extensive studies, using scientific tools to quantify subjective experiences. They analyzed the concept of “deliciousness” through psychology, nutrition science, molecular gastronomy, and other disciplines to guide product improvements.

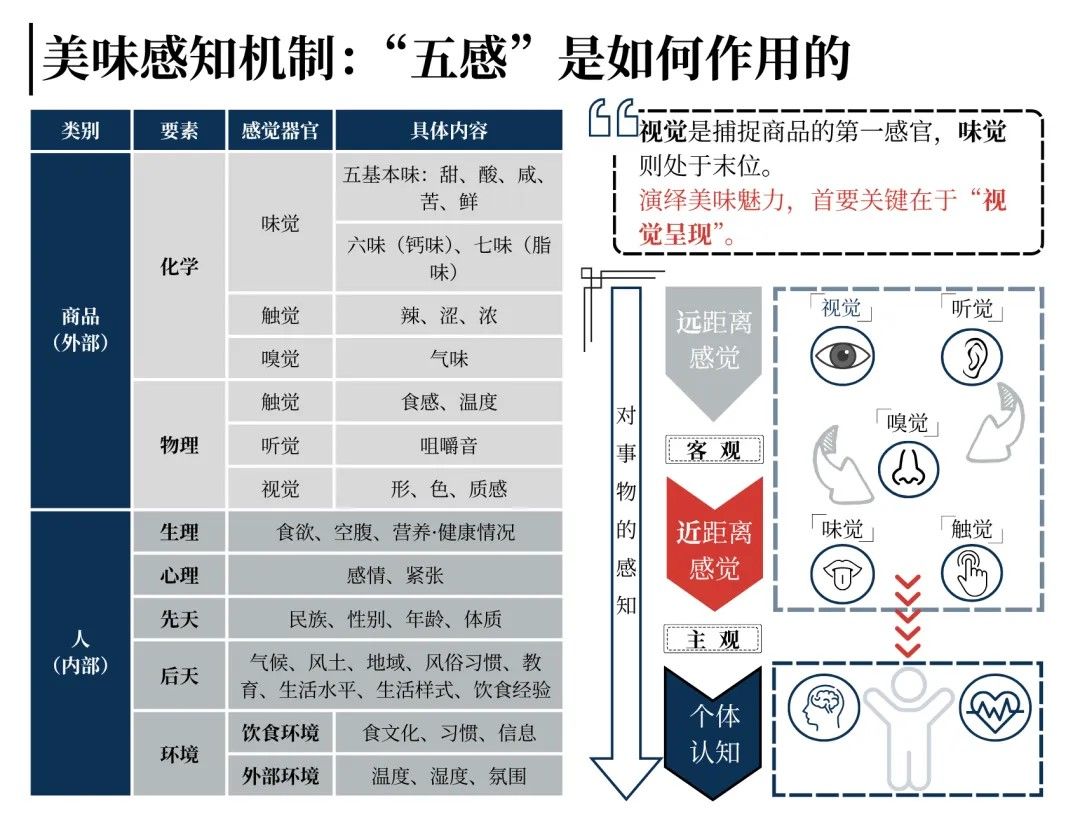

They discovered that “deliciousness” has little to do with taste alone—it is a combination of multiple sensory inputs. When judging food, consumers process stimuli in the following order: visual, then auditory, followed by smell and touch, and taste last.

In other words, long before taste buds come into play, food has already formed an impression in the consumer’s mind. To create a popular product, one must activate multiple senses—and sometimes even emotional cues—to signal “deliciousness.”

The flavor-perception framework proposed by food development expert Arao Hitoshi

For instance, Glico excels in using rhythmic syllables—like the Japanese series “Pa, Pi, Pu, Pe, Po”—along with sound associations to shape product identity. Its signature snack “Pocky” includes the explosive consonant “po,” which sounds crisp, while “ki” suggests a long, pointed shape. Hearing the name naturally evokes the pleasant sound of snapping a long biscuit stick.

Through mechanisms such as “lifestyle research centers,” consumer companies were able to consistently provide fresh, high-quality insights to product managers and staff while also fostering a more inclusive culture—creating the conditions for sparks of innovation to emerge.

Using new products to open up new markets

In a buyer’s market where supply exceeds demand, mere imitation only leads to cut-throat competition and price wars.

In response, product development expert Nobuyoshi Umezawa introduced the concept of “Market-Innovating Products” (MIP)—products that address strong unmet needs in consumers’ lives and thereby create new markets. Such products not only allow companies to escape red-ocean competition but can also help entire industries identify pathways for structural growth.

This principle is well illustrated in the development of Japan’s dairy industry:

Since 1996, total dairy consumption in Japan has declined from its peak; milk consumption has continued to fall, decreasing by an average of one percentage point annually from 1990 to 2020.

In response, dairy companies pursued diverse competitive strategies, continuously launching high-value, innovative products: Yakult, Morinaga’s aloe yogurt, Megmilk Snow Brand’s visceral-fat-reducing yogurt, Meiji’s anti-gout yogurt, and more.

These innovations shifted Japanese dairy consumption toward higher nutritional value, diversified flavors, and enhanced functionality. Yogurt consumption grew at an average annual rate of 4.23%, and cheese consumption surged by 25% over 25 years. Ultimately, the sector rebounded, with overall dairy consumption steadily recovering and reaching new highs from 2011 onward.

One product example helps illustrate what an MIP is and how such development works.

From 1994 to 2003, Japan’s ice-cream market declined for ten consecutive years. The downturn was partly due to the bursting of the economic bubble and partly because ice cream is highly substitutable: drinks cool more directly, yogurt ranks much better in health perception, and traditional ice cream is difficult to store and carry without compromising taste.

Lotte even considered exiting the ice cream category altogether—until 2003, when “Coolish,” an ice cream packaged in a squeezable jelly-style pouch and “drinkable with one hand,” was launched, changing the situation dramatically.

During development, Coolish systematically examined the advantages of competing categories and improved upon traditional ice cream accordingly:

As a “drinkable ice cream,” it mimicked the texture of beverages and jellies yet delivered a sweeter and more refreshing experience, reclaiming consumption occasions lost due to convenience issues.

As a pouch-pack dessert, it offered a café-quality frozen treat comparable to a Frappuccino—without the need to visit a café—thus capturing part of the casual dessert market.

Coolish quickly became a hit in Japan and even won an award at the SIAL International Food Innovation Competition—becoming the first Asian product to receive this honor.

According to Japan Food Industry News, Coolish generates roughly ¥12 billion in annual sales—accounting for one-quarter of Lotte’s total ice cream revenue—and revitalized the sluggish ice-cream market, becoming a new driver of category growth.

This case illustrates that the core of MIP development lies in breaking down user value across layers, moving beyond imitation, and defining a new value proposition. Only then can companies escape endless competitive spirals and enter a positive growth cycle.

Using emotion to awaken demand

Beyond functional innovation, Japanese companies also pursued another path: employing anthropological research methods to deeply understand subconscious user needs and using emotional triggers to awaken latent desires consumers themselves may not recognize.

Some researchers went directly into consumers’ homes to observe daily behaviors and conduct in-depth interviews, uncovering hidden thoughts and habits.

Other companies recruited consumers to keep lifestyle diaries documenting their feelings while using products or going about their daily routines. They also conducted numerous focus-group interviews, inviting representative consumers to discuss lifestyle themes freely, thereby extracting emerging trends and preferences.

Using this approach, Suntory developed “Iyemon,” a bottled green tea that eventually became a nationwide sensation.

To challenge Ito En, the dominant player in bottled green tea, Suntory’s research team focused on the core user group—males aged 40 and above.

Through meticulous interviews, researchers found that this demographic faced pressures from society, work, and family and deeply desired recognition and emotional relief. Tea, symbolizing a slower pace of life and nostalgic comfort, aligned naturally with these emotional needs.

Thus, Suntory boldly positioned its bottled tea as a “bottle for grown-ups,” aiming to meet consumers’ emotional desire for comfort and release. In television ads, Suntory portrayed an idealized couple—the wife gently encouraging her husband, who remains dedicated to tea-making despite repeated setbacks.

This concept strongly resonated with consumers. Iyemon sold out within four days of launch and became a record-breaking hit in its first year—one of the most iconic beverages in Japanese history.

Another compelling case is Calbee’s fruit granola.

Initially, Calbee’s team assumed cereal wasn’t selling because it didn’t taste good. However, deeper research revealed that the root issue was the “guilt” felt by mothers:

Mothers traditionally wanted to prepare homemade, nutritious breakfasts for their children. Serving cereal was seen as lazy and unhealthy. They needed convenience but feared compromising their children’s nutrition.

Addressing this emotional barrier, Calbee upgraded the product: adding dried fruits, nuts, and fortified vitamins to enhance nutritional value and health appeal—making mothers feel more comfortable serving cereal as a primary breakfast option.

Simultaneously, they promoted pairing cereal with milk, yogurt, and fresh fruit—positioning it as “one bowl of nutritious, love-filled breakfast.”

This dual positioning met children’s desire for taste while alleviating mothers’ guilt, significantly improving product acceptance.

As a result, this 1991 product experienced a remarkable revival: annual sales grew from ¥3.7 billion in 2010 to ¥22.1 billion within four years. Fruit granola has remained Japan’s top-selling cereal for years, revitalizing and expanding the entire category.

Learning from Japan: What comes next for China’s consumer innovation?

Today, China’s consumer market exhibits many similarities to Japan’s past: slowing macroeconomic growth, diminishing demographic dividends, growing aging population, and the coexistence of mass low-price consumption with diversified niche consumption. As the new-consumption boom cools, category competition is also approaching saturation.

It is therefore clear that China has entered a new stage driven primarily by consumer demand. The market is shifting from a seller’s market to a buyer’s market. Companies must begin with user insight and proactively create new product value, rather than relying on distribution expansion or price cuts to win favor.

The core of Japan’s product-development methodology lies in revisiting products entirely from the user’s perspective. Through rigorous user research and data analysis, Japanese companies optimize every stage—from product planning to cost control to shelf management—around consumer needs, enabling them to continuously launch products that precisely address user pain points.

This consumer-centric philosophy is the secret behind the enduring success of Japanese companies—and serves as the most important lesson for Chinese enterprises: in a demand-driven era, only by continuously improving products and experiences around real user needs can brands stand out in an increasingly saturated market.