Overview of this episode

In recent years, China has seen the emergence of numerous next-generation retail chains with over 10,000 stores, such as Busy Ming Group, Guoquan, and Mixue Bingcheng. Regional retail has also been booming, giving rise to thousand-store brands like New Joy Mart and Qiandama.

At the height of internet development, offline retail was once viewed as an “inefficient channel in need of empowerment.” However, today, many attempts to "upgrade offline retail with online solutions" have hit a wall. The industry is gradually realizing that internet companies' familiar playbook of “burning money for scale” does not translate into sustainable mindshare among offline consumers. This is especially true in high-frequency, low-price categories like fresh food and dining, where offline channels still possess irreplaceable value.

At its core, retail transformation is the process of efficient business formats squeezing out inefficient ones. Thus, the real opportunity in retail lies not in online players dominating offline business, but in offline retail evolving autonomously into more efficient models—while leveraging online tools to expand their business footprint.

So, how exactly is this self-evolution of offline retail happening?

Since its founding in 2017, GenBridge Capital has regarded "new generation of national retail" as a core investment theme, witnessing and supporting the development of offline retail in China. We believe this evolution hinges on three key factors:

- Category Focus: Meeting consumer needs more precisely

The era of the “one-stop hypermarket” is over. Category-driven, consumer-centric retail management is gaining traction across the industry. Becoming a “category killer”—deeply specializing in one category to fully meet consumer demand—has become the common path for new offline retailers.

Take Qiandama, a community-based fresh food chain backed by GenBridge, as an example. It has taken the “meat” category to the next level. Traditional meat retail often struggles with freshness versus spoilage. Qiandama’s bold slogan "never sells overnight meat" uses a day-clearance pricing model that adjusts discounts by time slot. This innovative strategy transformed a long-standing industry pain point into a powerful marketing tool, simultaneously addressing consumers’ dual desire for freshness and affordability, while enabling customer segmentation.

Beyond fresh meat, there are opportunities in categories like bulk snacks, hotpot ingredients, and fresh ready-to-eat meals. Brands like Snack Is Busy, Guoquan, and New Joy Mart have all excelled by mastering a single product category.

- Franchising: Enabling rapid, high-quality store expansion

Achieving "10,000-store scale" would not be possible without the support of a new wave of retail franchising. Backed by digital capabilities and mature supply chains, these franchising models are no longer the old, loosely organized "scams" that left franchisees hanging. Instead, they operate under standardized systems for centralized procurement, visual merchandising, store management, and customer service.

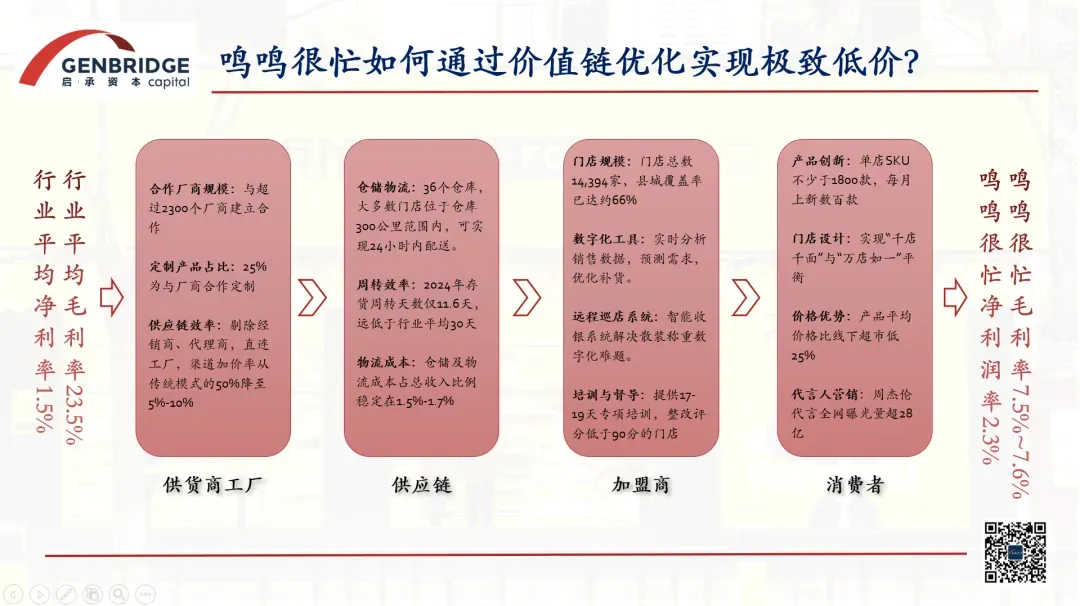

For instance, when you walk into a Snack Is Busy store, you’ll see a layout as polished as a direct store. This is made possible by their innovative remote store inspection system, which uses smart cameras to score store conditions. Franchisees also don’t need to worry about sourcing products—centralized procurement has already optimized the process to be extremely efficient.

Moreover, professional “super franchisees” are emerging as a vital force, injecting new energy into offline retail. Many now treat franchising as a full-time career, operating multiple brands and stores within a region. Their familiarity with the modern franchise system enables rapid and high-quality scaling.

- Shortened Supply Chains: Ensuring long-term profitability

Whether a retailer can shorten its supply chain determines its ability to maintain healthy profits in an increasingly price-competitive market. Today, more and more retailers are reforming traditional supply chains through direct sourcing, manufacturing alliances, or even building their own factories.

For example, Snack Is Busy sources directly from manufacturers, cutting out multiple layers of distribution for bulk snacks—reducing prices by 30% or more. Guoquan Shihui has acquired or built several dedicated factories to self-produce key items like shrimp paste, beef slices, and hotpot bases. XinjiaYi Convenience Stores are transitioning into manufacturing-oriented retail by launching private-label fresh milk priced at just 9.9 yuan per liter. These supply chain strategies not only boost price competitiveness but also sustain a healthy profit model.

With “10,000+ stores” becoming the norm, the next phase of retail will shift from “growing fast and large” to “growing strong and lasting.” The focus will move from total store count to same-store sales performance. As this transition unfolds, we expect to see even more outstanding retail practices emerge across the industry.

Timeline of topics covered in the issue

06:05 — Why is community-based offline retail growing so rapidly?

14:09 — Why don’t online strategies work for offline retail?

18:40 — What are the irreplaceable advantages of offline retail?

24:16 — Who are the “category killers” in Chinese retail?

33:09 — How are 10,000-store community chains built?

36:52 — From “loosely linked” to “10,000-store networks”: How has franchising evolved?

46:12 — China’s fastest-growing chain: What is Snack Is Busy doing right?

52:58 — The anchor of mega chains lies in lower-tier markets

01:00:20 — What’s next after reaching 10,000 stores? From rapid growth to long-term strength