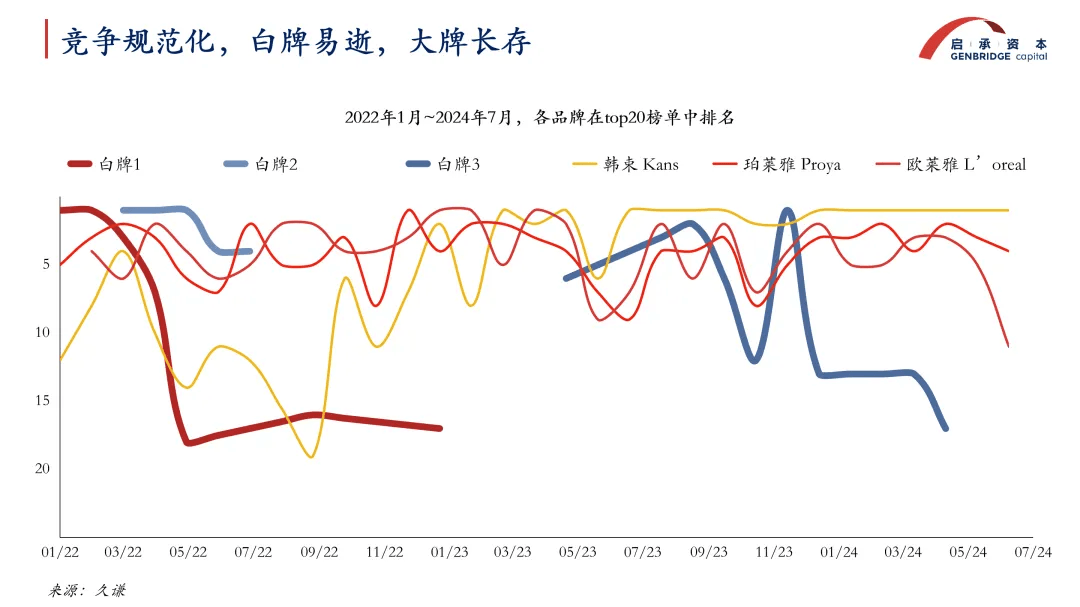

A noteworthy shift is occurring in this Double 11 shopping carnival: the top spots on the sales charts are now dominated by well-established, product-solid brands that have been operating for years. In contrast, marketing-driven and white-label brands that once surged ahead on the back of content-driven growth have all but disappeared from the rankings.

This is not an isolated case. In fact, a comparison of TikTok’s Top 20 brands from January 2022 to July 2024 reveals a clear trend: brands that relied heavily on short-term traffic windfalls—without building long-term foundations—are now on a noticeable decline.

This structural shift is driven by a combination of factors: the plateauing of traffic, the decentralization of content supply, and a broader consumer slowdown. The once-effective “flood-the-market” strategy is losing its edge, now reduced to an exhausting, zero-sum arms race that yields little sustainable growth.

How can brands create more effective content while the traffic dividend has faded?

GenBridge Capital believes that in this new consumer era, the role of content is also evolving. As infrastructure for content channels matures, the distance between “wanting to buy” and “buying” shortens for consumers. This presents an opportunity for brands to gain user insight through content channels—shifting the focus of content from “blind expansion” to “driving quality growth.”

To help brands navigate this shift, GenBridge brought together industry experts from TikTok, Guoquan, leading content agency Shan Rong Zhu, and senior executives from content-savvy consumer brands at the 2024 GenBridge Portfolio Gathering. Together, we explored how brands can break through with content in an era of contraction.

With insights from internal research and external experts, GenBridge seeks to answer four key questions in this article:

- How can content support brand innovation?

- How can content create more consumer touchpoints?

- Where does an efficient content supply chain come from?

- How can content spillover effect be maximized, ensuring no investment is wasted?

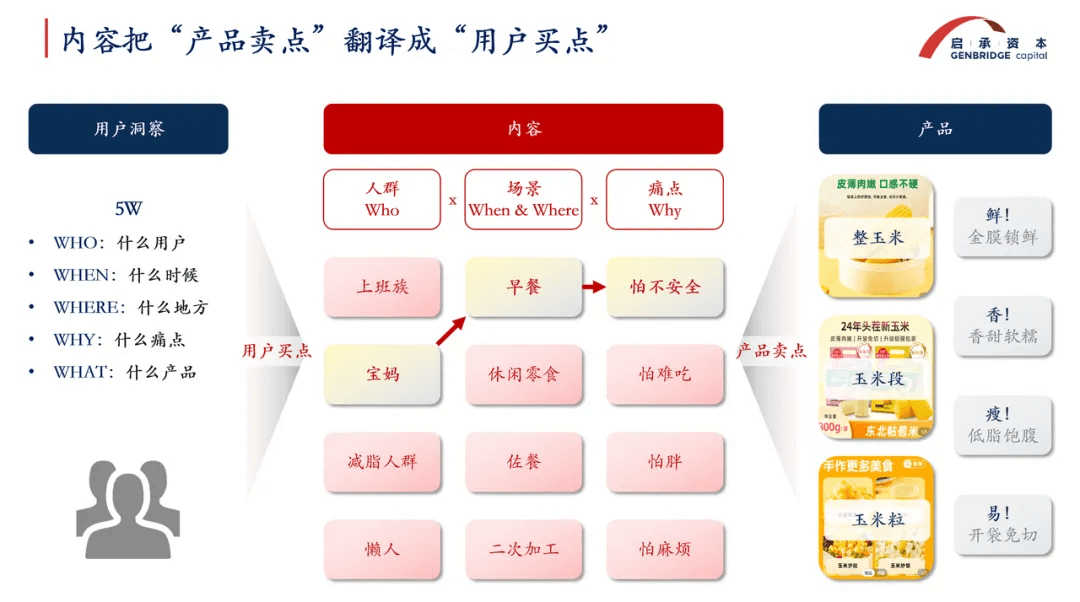

Content is the translator between “product selling points” and “consumer purchase triggers”

During the content boom period, brands often treated content purely as a growth lever. It boosted sales but wasn’t integrated into the full product design and development cycle. In reality, content’s ability to generate interaction and insights can power continuous innovation—key to building brand longevity.

Let’s look at a case study from Japan.

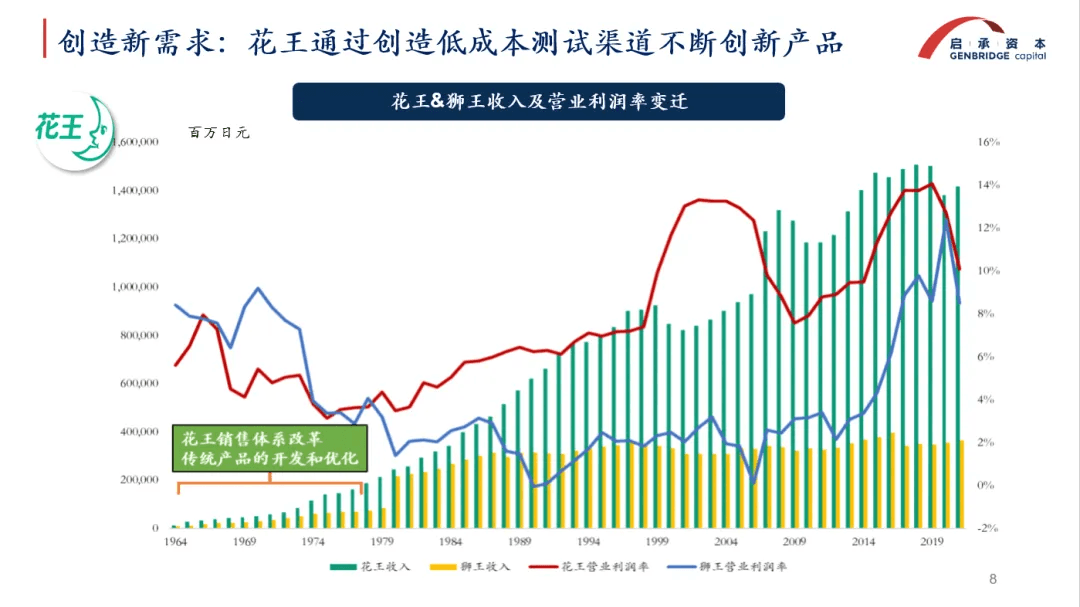

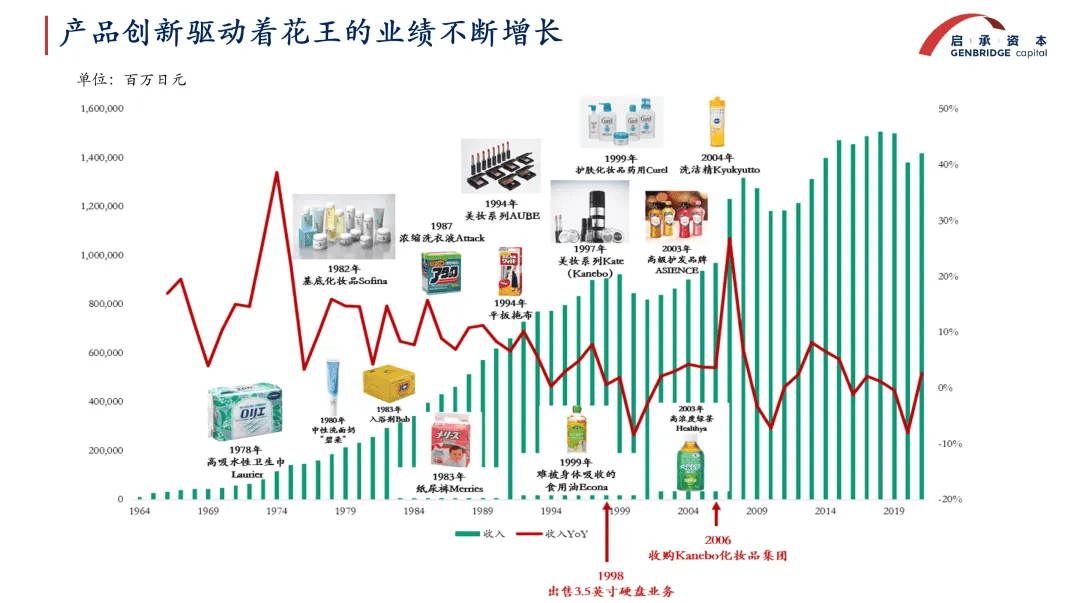

In Japanese business history, two long-standing rivals, Kao and Lion, have much in common: both founded in the 1890s, focused on personal and household care products.

In the '60s and '70s, their revenue was neck and neck during this Japan’s high-growth era . But in the '80s, when Japan entered the saturation era, Kao began pulling ahead—today it earns 7 times more than Lion.

What did Kao do right?

In 1960-1970, Kao undertook difficult reforms to unify its distribution channels—replacing dealers with its own sales companies and establishing tight control over retail outlets. This created an efficient, low-cost product testing network. In the saturation market era of the 1980s, Kao’s continuous product innovation gave it the edge over Lion.

Now, China’s consumer brands have even more advanced commercial infrastructure and testing tools. Social logistics and supply chains are mature, and platforms like TikTok and Xiaohongshu enable fast, low-cost feedback loops. Content drives low-cost innovation, helping brands stay alive and agile.

Even if the product doesn’t change, content storytelling can open new growth opportunities.

At P&G, marketing innovation is as critical as product innovation, because content is all about consumer insights. It requires persistent probing of pain points and usage scenarios.

Take Tide’s laundry powder ads: the same product is pitched differently to different audiences. For those who hand-wash, the message is “as clean as machine wash.” For those worried about water temperature, the pitch becomes “cold wash is as clean as hot wash.” Content innovation translates selling points into diverse buying triggers, awakening hidden consumer demand.

The rise of content platforms gave many new brands the chance to leapfrog incumbents, however, this ease also narrowed their understanding of “content.”

For example, Harvest launched a fresh sweet corn product featuring a "golden film freshness lock." While "golden film" is the selling point, the term itself holds little meaning for consumers. Only through content—by bridging audience, scenario, and pain point—can "golden film" be translated into a tangible user need.

A company’s long-termism is inseparable from innovation, and content is precisely the entry point for both product and marketing innovation. It can create value at every stage of the brand's business cycle.

Everything can be content: breaking conventional boundaries

The rise of content platforms gave many new brands the chance to leapfrog incumbents—but this ease also narrowed their understanding of “content.”

Consumers often think of content as just videos and articles, limited to a few mainstream platforms. In reality, content is everywhere—wherever consumers are, content must follow. This calls for broader imagination about content channels and more refined execution.

Products = Content. A product contains multiple content layers—name, packaging, design—all communicate something.

For instance, new-generation sugar-free teas almost all come in square bottles. Take “Guozishu Le” sugar-free tea—its bottle is wider and flatter. The design choice? Square bottles show more info on one face than cylinders, and are easier to hold with your phone.

Good design is inherently content-rich. Take M Stand’s coconut latte—they inject espresso into a fresh coconut using a syringe. It instantly communicates “freshly made,” far more effectively than saying “10-hour freshly picked Thai coconuts.”

Channels = Content. Offline setups are just like livestreams—they must display as much information as possible. Location, display, signage—all carry content value.

For example, opening a store across from Lululemon sends a different message than across from Septwolves. After signing a new spokesperson, P&G mandates that their standee be visible from 10 meters. At retailers like Don Quijote or Pang Donglai, product cards detail everything—source, taste, cooking method. Great content is a store’s competitive edge.

Key People = Content. The complaint number for Coconut Palm Juice is a personal mobile number. A real uncle answers 24/7—chitchat or complaint, he’s always there. That builds more trust than any automated hotline.

Founders, employees, influencers—they’re all part of your content network. In today’s era of equal access and transparency, brands have their own communication channels. From founder-led storytelling to store staff livestreaming, real people convey brand stories better than abstract logos.

Building a high-efficiency content factory

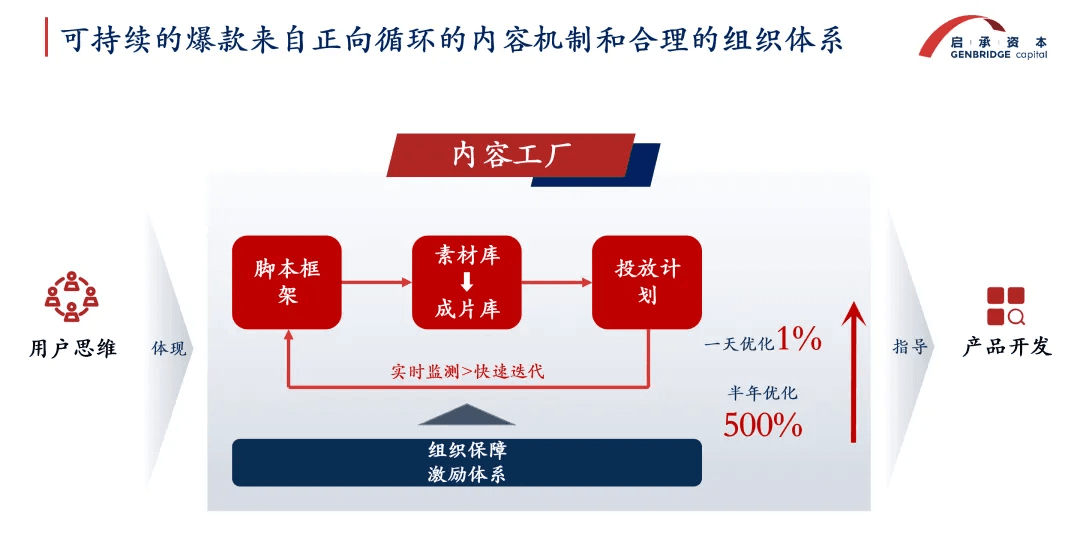

Good content isn’t about sudden inspiration. Consistent viral hits come from systematic mechanisms, supported by a sound organizational structure.

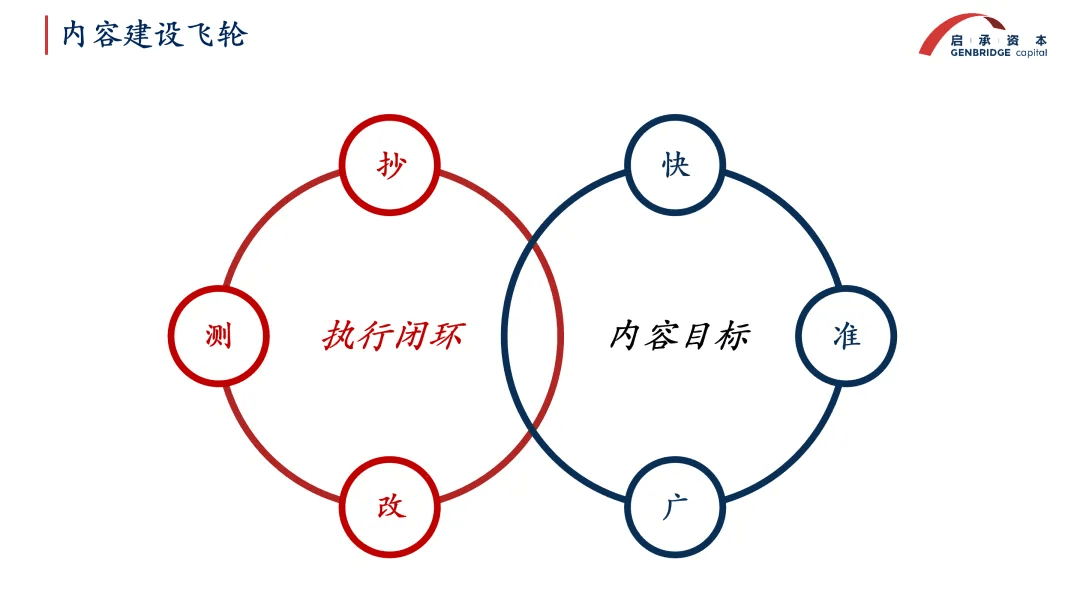

The flywheel of content creation is powered by the closed loop of “copy, test, iterate.”

Teams must dissect viral content to extract its core logic. After broad research and analysis, teams build a tangible “muscle memory” of what works. Dissecting the structure and storytelling logic down to the smallest usable unit lets teams plug-and-play like a fill-in-the-blank.

With enough scripts and assets, testing them at scale with users yields data to refine them further—greatly increasing the hit rate of viral content. Validated content can then be reused for livestreams, e-commerce, or private traffic pools.

This is a rapid iteration model: optimize by 1% daily and you get 500% over half a year. It also shifts the team mindset from seller-thinking to user-thinking, which can guide future product development.

When broken down, if the execution loop can be effectively implemented, it is possible to achieve content goals that are fast, precise, and far-reaching—all at a relatively low marketing cost.

The key to this model’s success is rational team incentive structures. Great teams aren’t made of lone geniuses—they’re born from collective creativity under the right incentives.

The content team must be closely linked to business operations. If the founder can’t lead directly, content should be part of e-commerce, not just marketing. For a brand with 1 billion RMB GMV, the ideal content team might have 45 members: covering content strategy, seeding, KOC (Key Opinion Consumers), and paid media (Qianchuan), each scaled accordingly.

When founders get hands-on, collaboration becomes faster. For example, when Guoquan launched a 6-person hotpot meal kit, the founder negotiated directly with the supply chain, led a cross-department team, and rolled out the product nationwide to over 6,000 stores in just two weeks.

Currently, content supply chains still lack economies of scale. Many quality third-party agencies remain scattered. In the future, integrating these into a unified platform can lower costs and boost efficiency.

The omnichannel battle: from content impact to maximum ROI

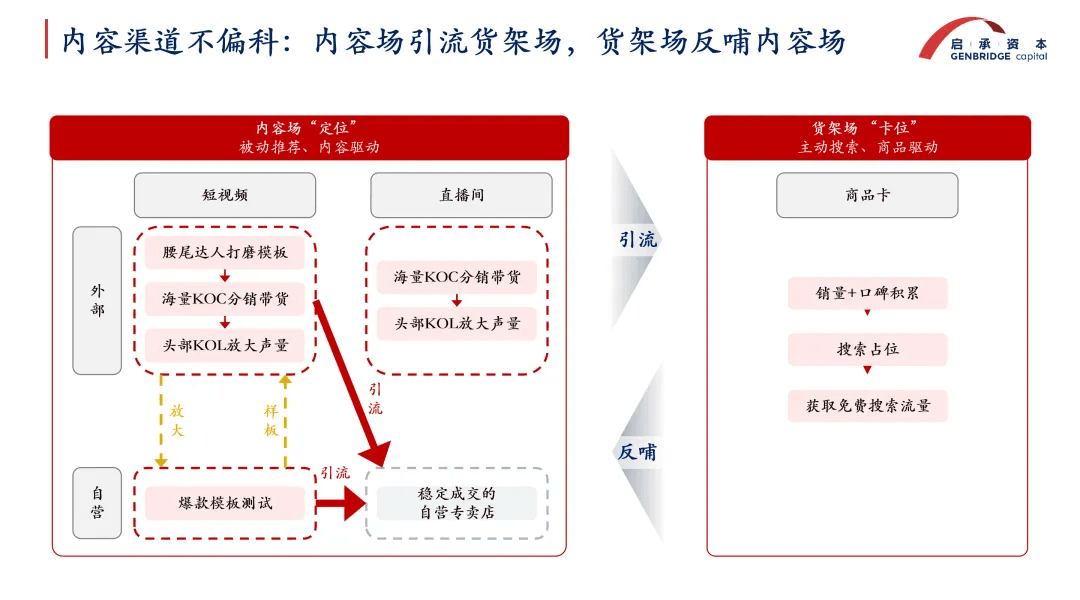

Once content production is running well, the next step is to maximize its impact.

High traffic costs are a result, not a cause. If brands focus solely on content platforms, conversion remains limited. But with omnichannel coordination, content can spill over, driving better return on investment.

The goal is to get users from passive recommendations to active searches. The omnichannel strategy hinges on positioning and placement: “positioning” means creating new search terms, and “placement” means dominating search results.

Step one is optimizing within TikTok itself. Many brands think they’re doing “pretty well” on TikTok, but content work is never really done—platform tools are always evolving.

Effectively using both the content layer (short videos) and shelf layer (search results) is foundational. Videos attract traffic; livestreams convert it; product visibility on shelf boosts both. Shelf traffic in turn reinforces content account authority.

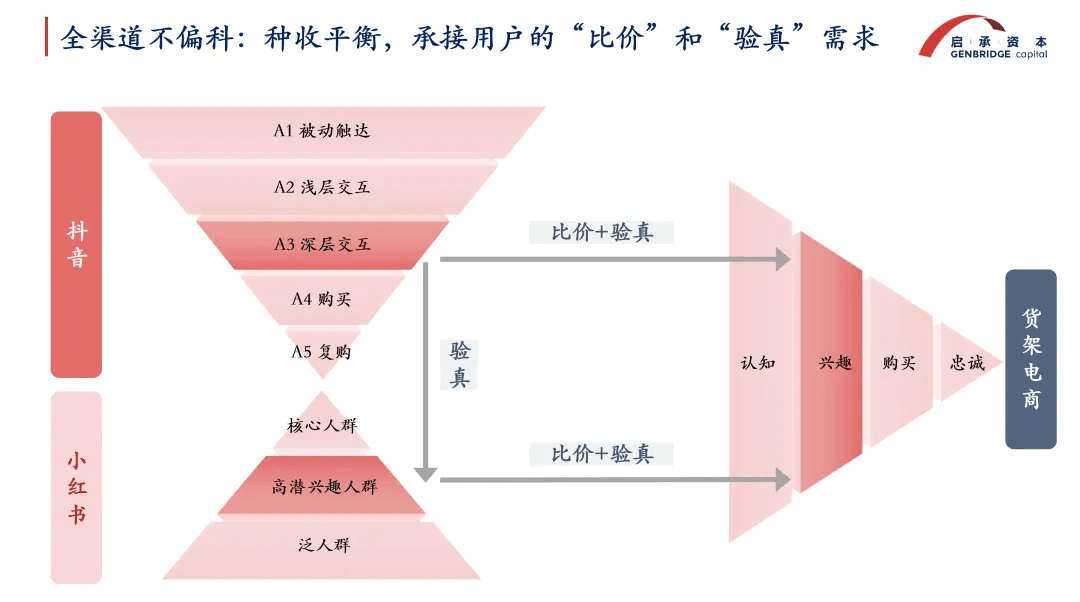

Step two is extending content momentum across platforms. But TikTok’s spillover isn’t automatic—brands must understand user cross-platform behavior and build seamless paths from “TikTok → Xiaohongshu → e-commerce.”

From the user’s view, the core action is search, for comparison and verification.

After being seeded on TikTok, users head to other platforms to check reviews. Thus, Xiaohongshu becomes a search zone linking content and search-driven e-commerce. Brands must create differentiated keywords and secure top search spots.Then users go to e-commerce to validate sales and reviews.

In this process, keyword selection is critical. Categories, functions, scenarios, upstream/downstream products—even competitor brands—can be entry points for capturing traffic.

This omnichannel setup is a coordinated offense and defense. If Xiaohongshu is full of negative reviews, or the e-commerce search turns up nothing—users won’t buy.

Unifying the user journey across platforms requires strong operations beyond just TikTok. Many brands claim there’s “no spillover,” but really, they just didn’t build the bridge. Without both positioning and placement, marketing costs stay high. Only by designing from the user’s purchasing perspective, and getting users to actively seek out the brand, can costs fall and efficiency rise.

Conclusion

Returning to the four questions raised at the beginning of this article, we’ve arrived at the following conclusions:

In this new phase, content is no longer just a tool for broad-stroke growth. To fully harness content’s ability to connect with consumers, brands must use low-cost content channels to deeply understand consumer needs and test products—driving continuous innovation through refined, intentional efforts.

Make full use of all possible touchpoints to present content. Products, channels, and key roles all serve as vehicles for content delivery.

The execution loop of "copy, test, iterate" enables content goals that are fast, precise, and far-reaching. A well-designed organizational structure and incentive system are essential to keep the content engine running effectively.

The cross-channel spillover effect of content doesn’t happen naturally—it requires intentional construction of user pathways across platforms. By focusing on two key actions—positioning and claiming strategic search terms—brands can meet users’ needs for price comparison and authenticity verification while maintaining a competitive edge.