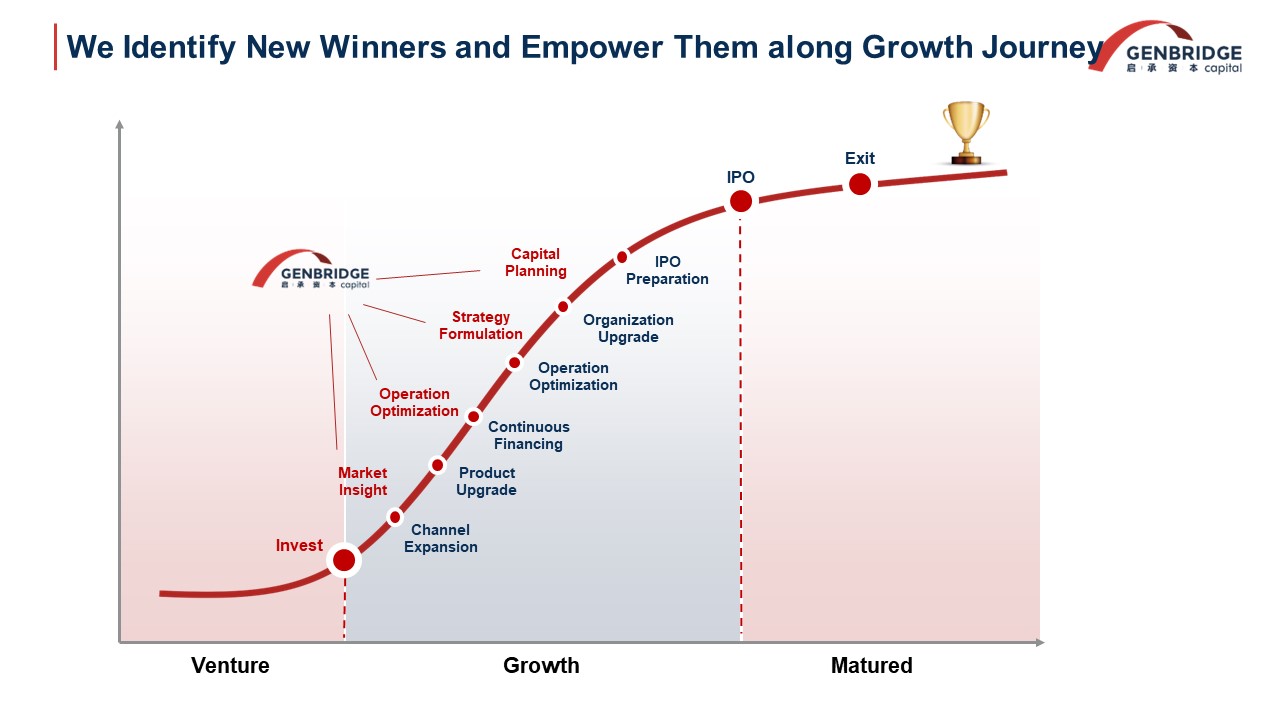

We are honored to be the first external shareholder for 13 portfolio companies and the primary external shareholder for 17 portfolio companies. Early-stage engagement by founders is not an easy decision, and their trust in us is profound.

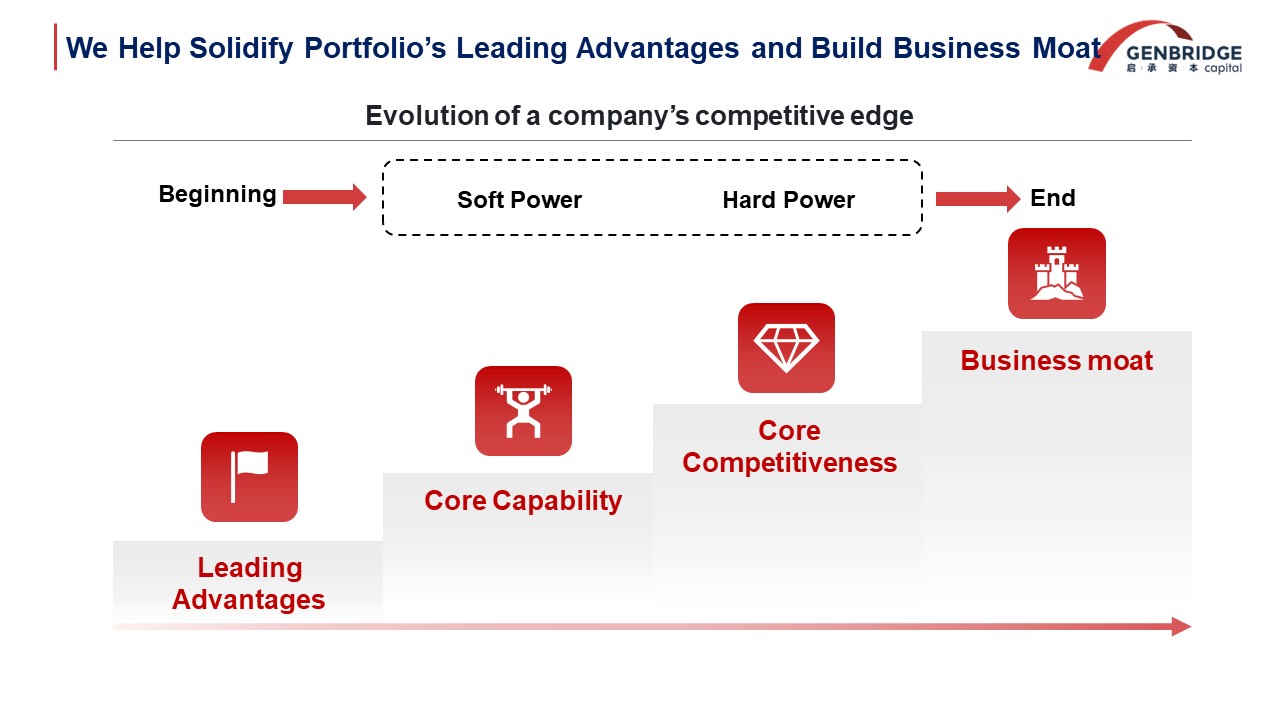

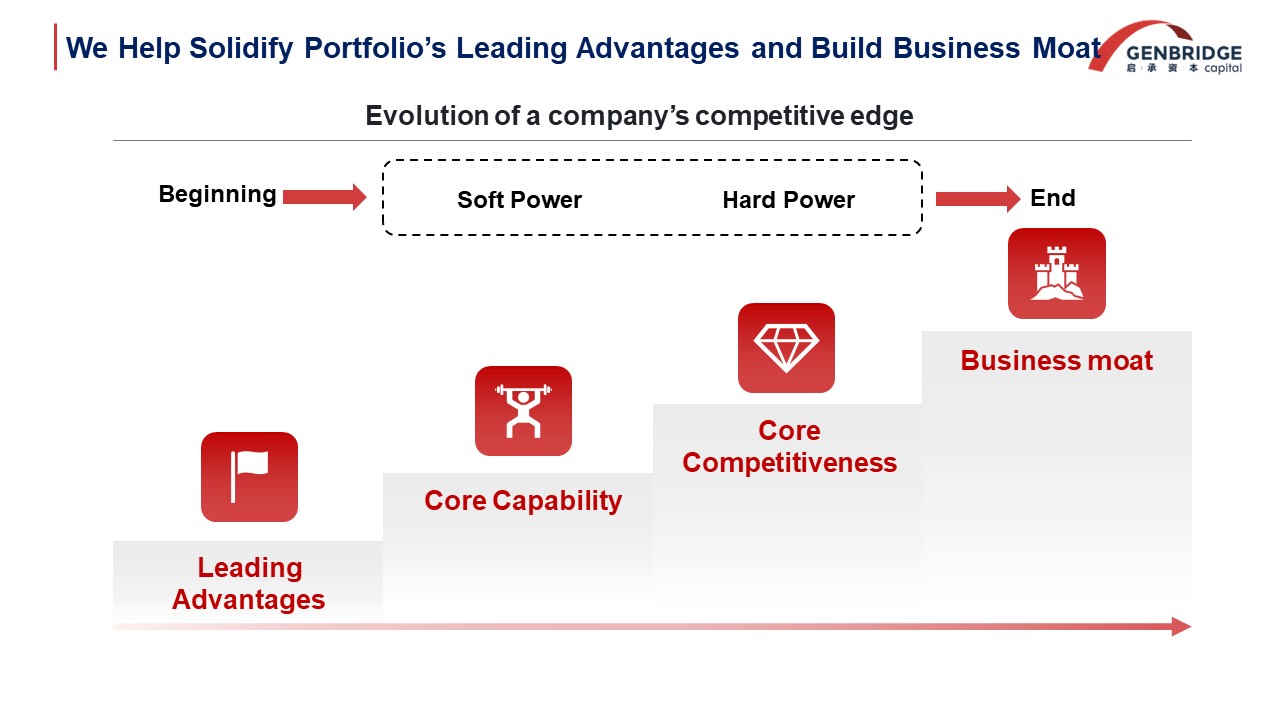

Looking ahead, we aspire to play a more significant role, ensuring not only the growth of the first curve but also aiding founders in creating a second curve, achieving sustained expansion through both organic and inorganic means. Many founders initially possess a few competitive advantages. During fundraising, they often face challenges: “Why you? Why not someone else? What if someone else does what you do?” We assist founders in transforming these subtle advantages into core competencies, eventually fortifying them into formidable business barriers that distinguishes them from everyone else.

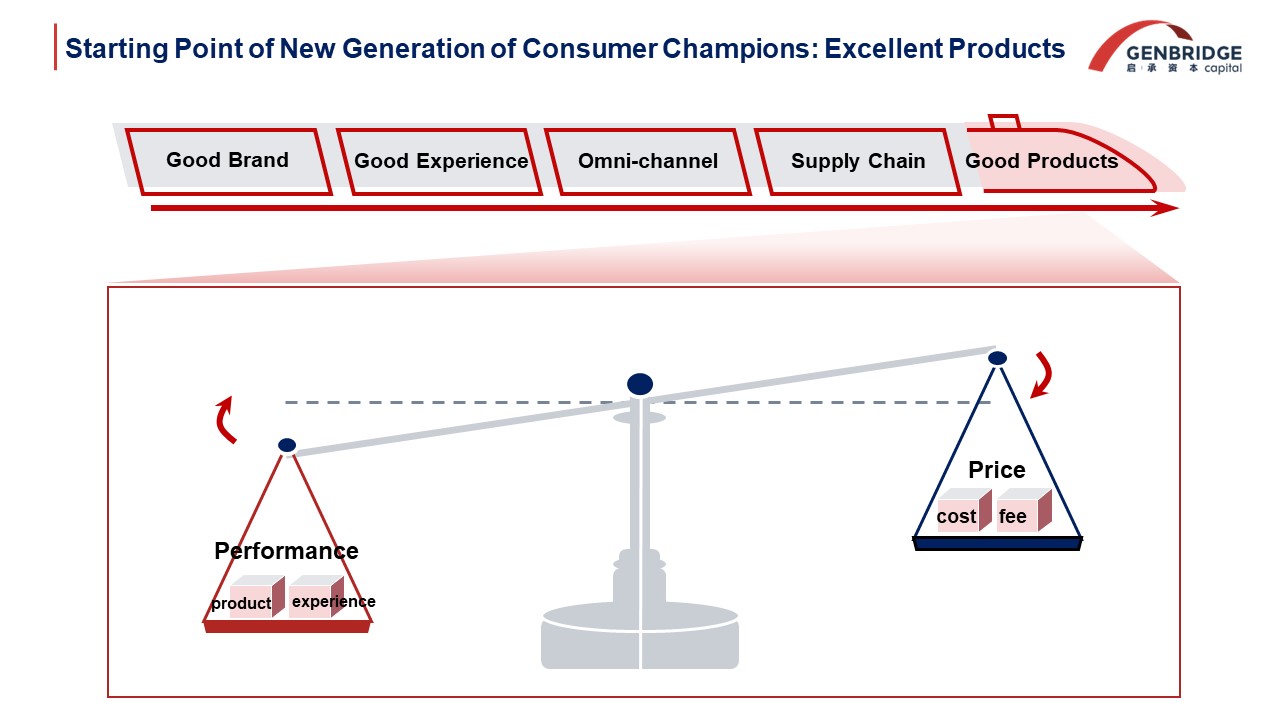

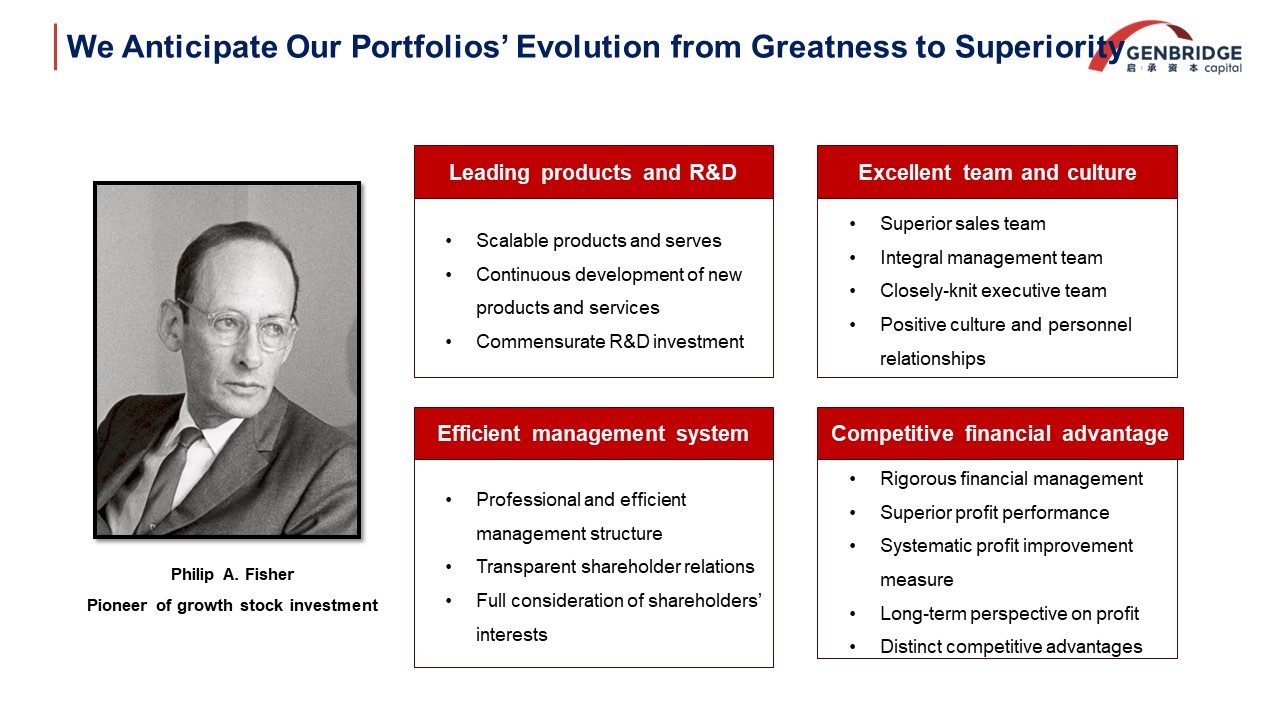

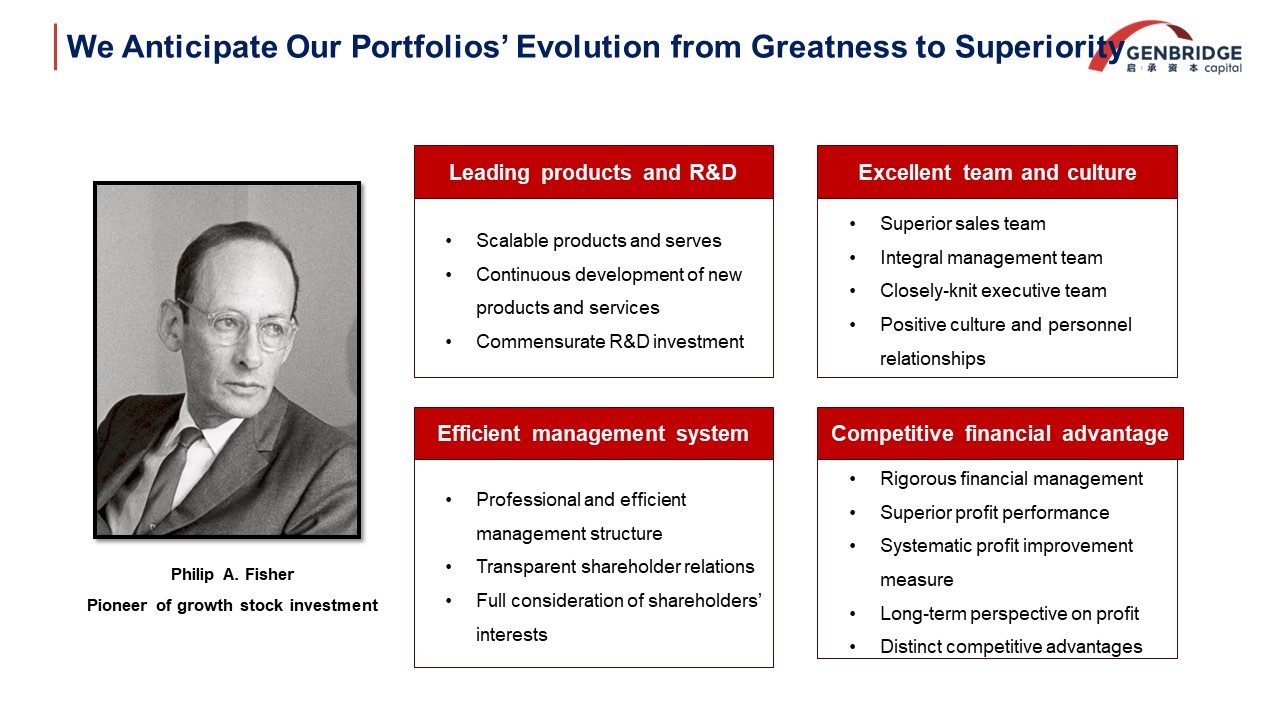

A renowned investor, Fisher, once mentioned the common characteristics of outstanding companies:

- They excel at creating leading and good quality products;

- They possess exceptional teams and cultures, operating cohesively;

- They have efficient corporate governance structures, effectively integrating internal and external resources;

- Lastly, they exhibit impressive financial performance and seemingly unassailable competitive advantages.

We anticipate our portfolio companies’ evolution from greatness to superiority.

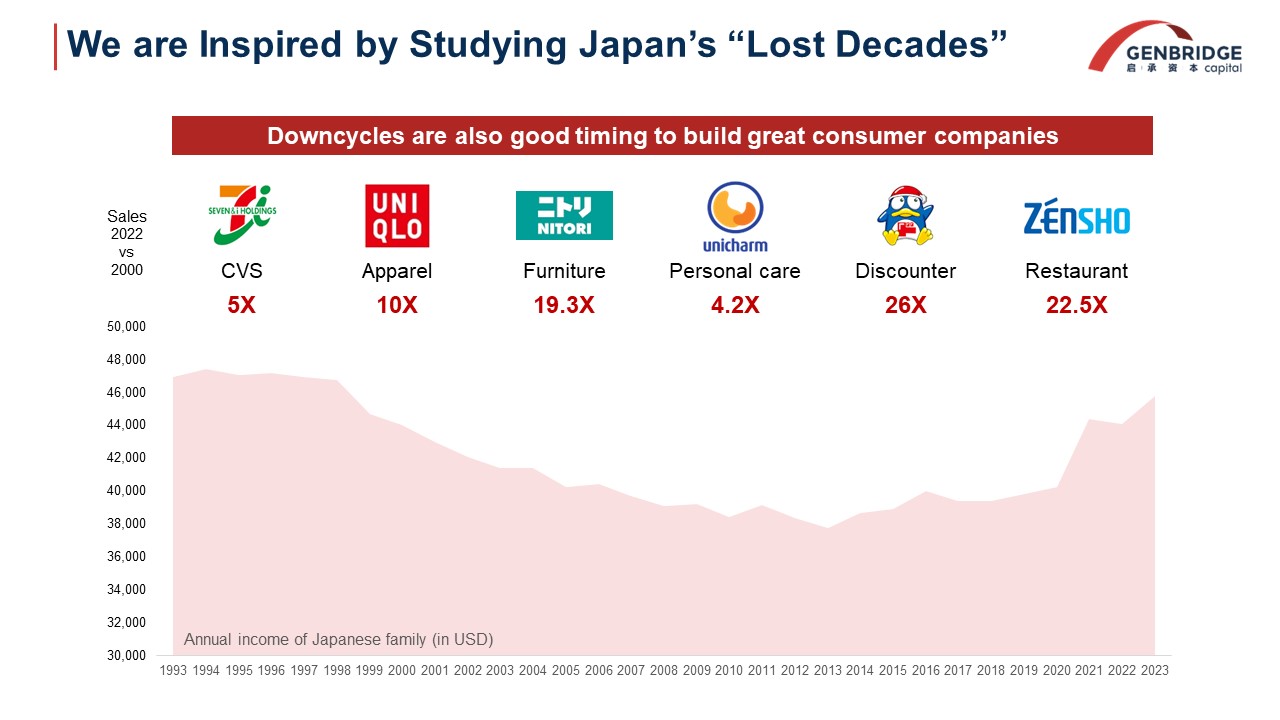

In recent years after the COVID-19 pandemic, China’s consumer market has shown gradual signs of recovery. However, the growth seems to be less robust compared to previous years, causing some to doubt the resilience of China’s economic trajectory and even draw parallels to Japan’s “Lost Decades”.

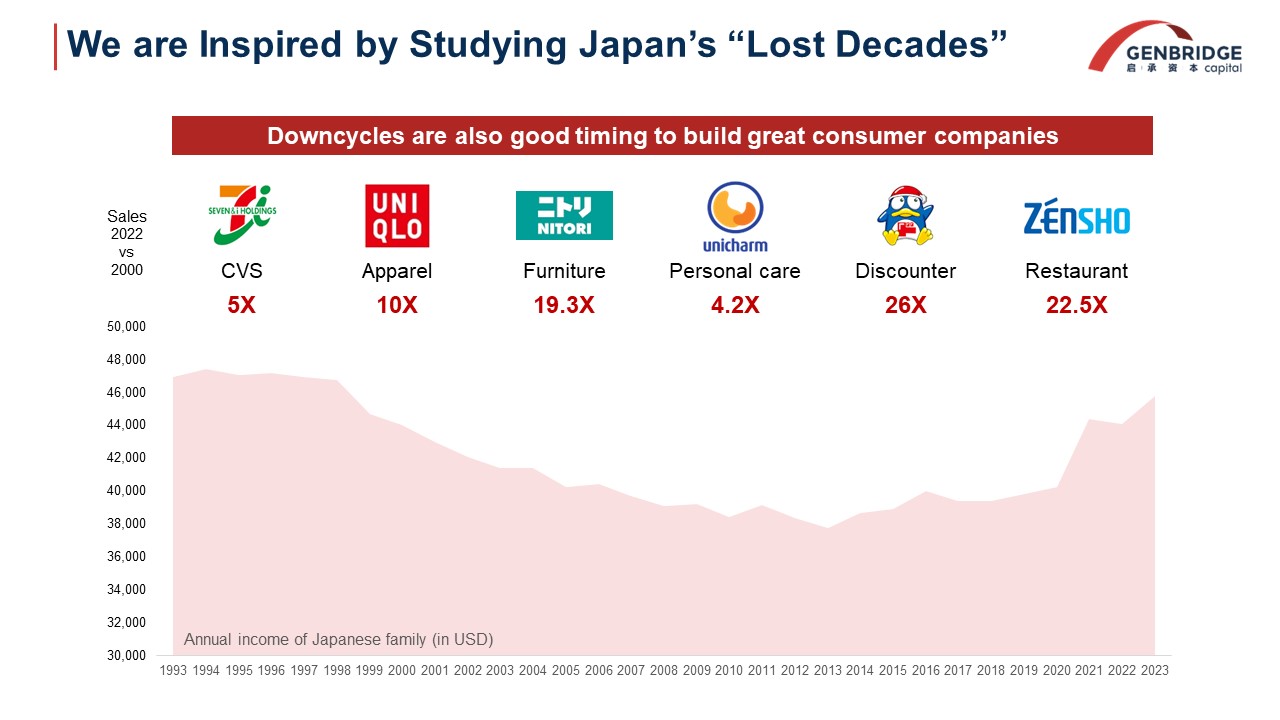

At GenBridge, we have extensively researched the Japanese market. Our preliminary conclusion is that while China and Japan possess fundamentally different market foundations, they are not directly comparable. Yet, even amidst Japan’s “Lost Decades”, a plethora of outstanding consumer-focused companies emerged, such as the globally recognized 7-11 convenience stores, Uniqlo, Japan’s “IKEA” – Nitori, Don Quijote discount stores, and Zensho’s dining establishments.

From our research, we gleaned four pivotal insights:

- Regardless of economic conditions, Japanese consumers continually upgrade their basic necessities. The quest for superior quality milk, coffee, beer, and tastier noodles never wanes; it only ascends.

- Rising Expectations for Convenience: Our study on 7-11 illuminated that while many channels may attract consumers through discounts, true buyer-centric markets comprehend and cater to user demands, offering distinctive positioning besides competitive discounts. Such market understanding has empowered 7-11 to maintain leadership over the past three decades and sharpen its edge even further. This trend is now evident in China with emerging brands like Qiandanma, Guoquan , and Busy for YOU. This is just a tip of China’s future 10000 national chains.

- Affordable Excellence: Japan, once a bastion of luxury consumption, witnessed a surge in demand for value-for-money products during economic downturns. Brands like Uniqlo and Nitori capitalized on this, as did discount formats like Don Quijote and Daiso.

- Adapting to Societal Shifts in Dining: Japan’s aging population and declining birth rates prompted innovative, cost-effective dining solutions for singles and small families. This underscores the pinnacle of efficiency in Japan’s food industry, where prices for meals like beef bowls and udon noodles remained unchanged for three decades, respectively at 20 and 18 RMB. This is true even when raw material costs surged. Rice in Japan costs twice as much as in China, but a beef bowl at Yoshinoya in Japan is still cheaper than its counterparts in China, demonstrating Japanese dining industry’s extreme efficiency.

While China may face a growth deceleration in the near future, a comprehensive study of Japan instills confidence in our portfolio companies. These enterprises are deeply rooted in China’s foundational consumer demands, consistently striving for enhanced quality— a timeless consumer aspiration.

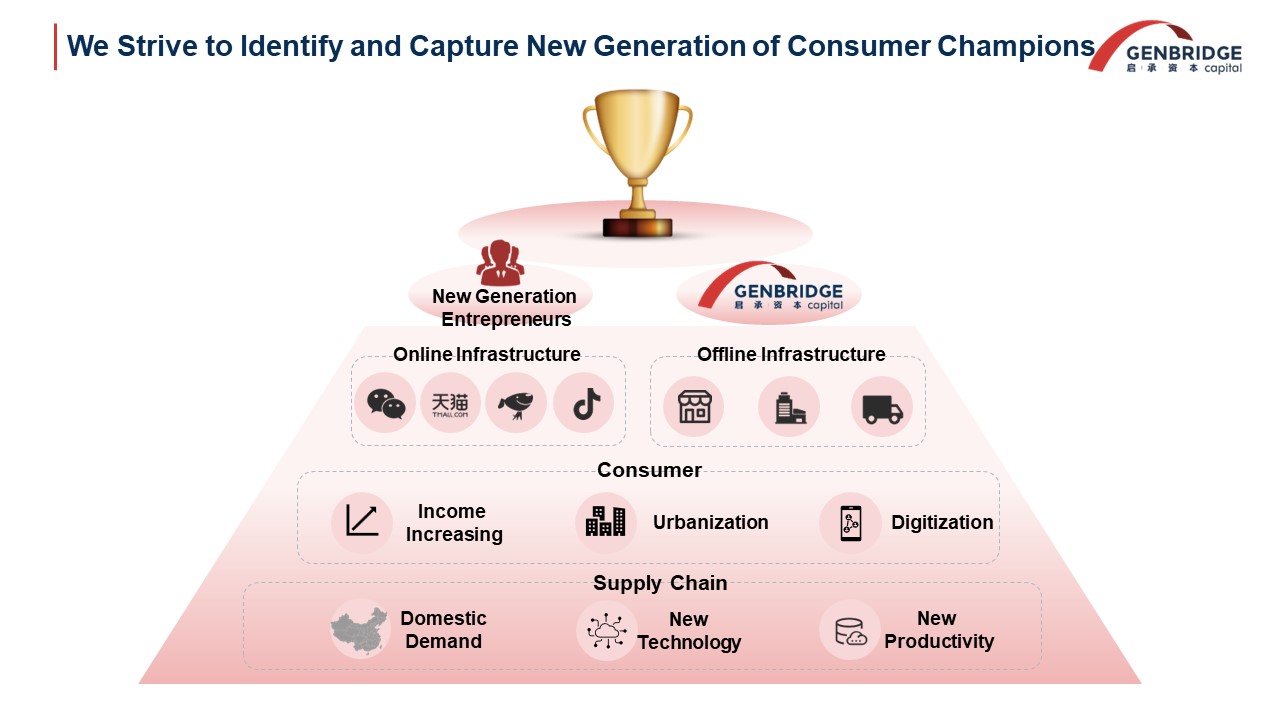

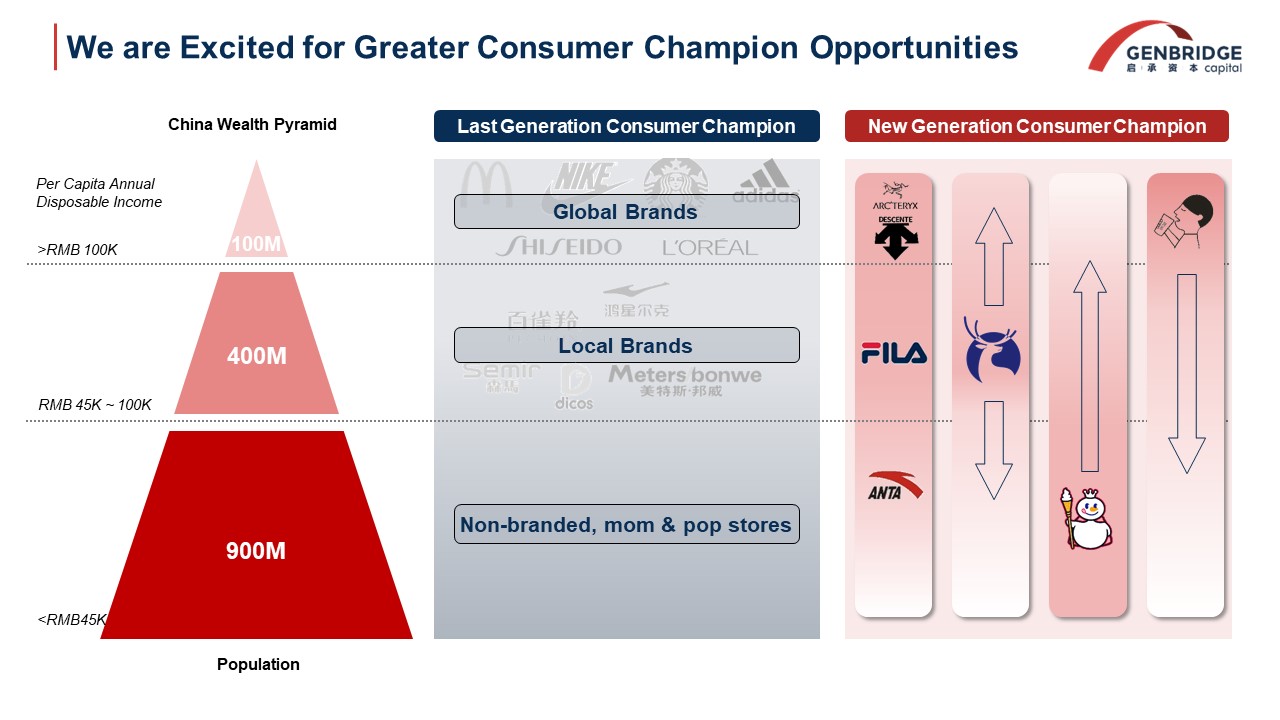

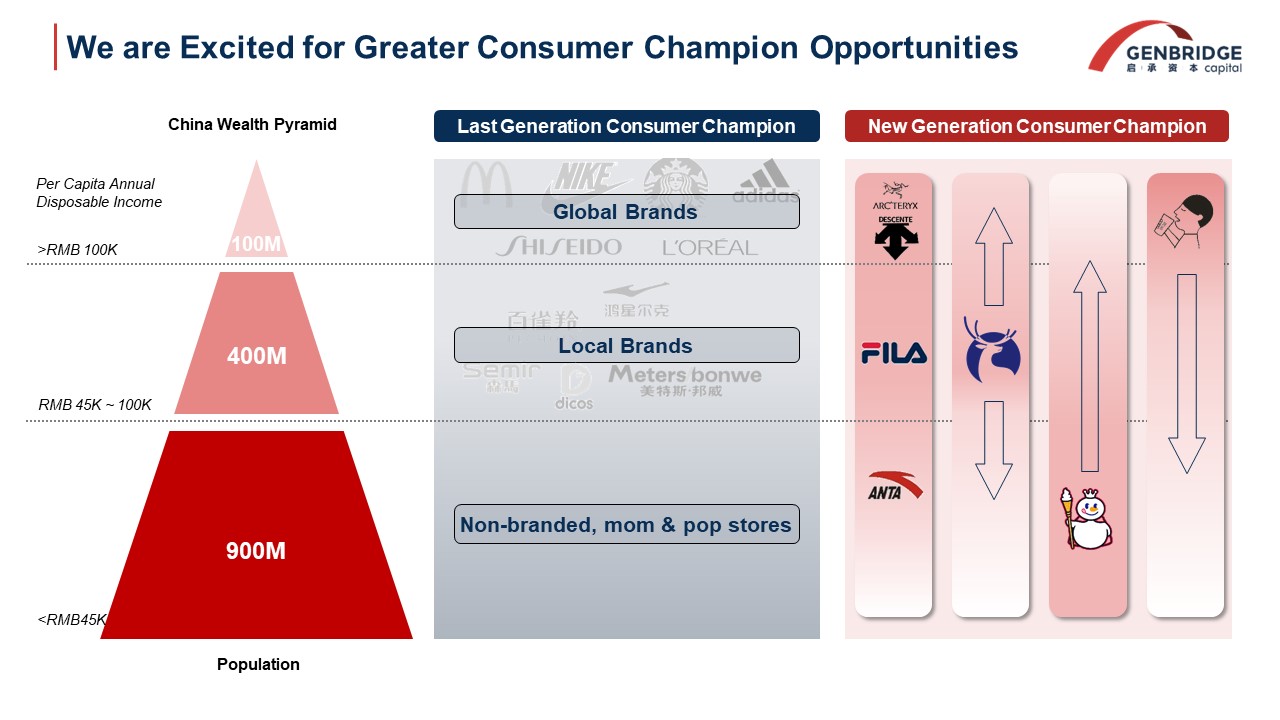

We believe China’s next-generation “consumption champions” will seamlessly bridge the needs of its 400 million middle-class and 900 million lower-tier city residents, forging truly national brands and dominant chains. While past perceptions centered on the consumption patterns of China’s affluent 400 million spending on mid-to-high end oversea brands like Starbucks or Nike, our reality encompasses a broader, 9 billion-strong mass consumer market. Numerous companies, starting from cities like Changsha, Zhengzhou, and Jinan, can penetrate townships and villages to even fourth-tier cities.

Historically, offline chains struggled to penetrate lower-tier markets, and e-commerce channels were less developed. However, today’s landscape, with nationwide chains, e-commerce platforms, and expansive logistics, witnesses rapid chain expansion in lower-tier markets. Brands like MIXUE capitalized on this, and Luckin’s rise beyond Starbucks underscores this transformation, offering products like Luckin’s Maotai Latte that truly resonate with Chinese tastes.

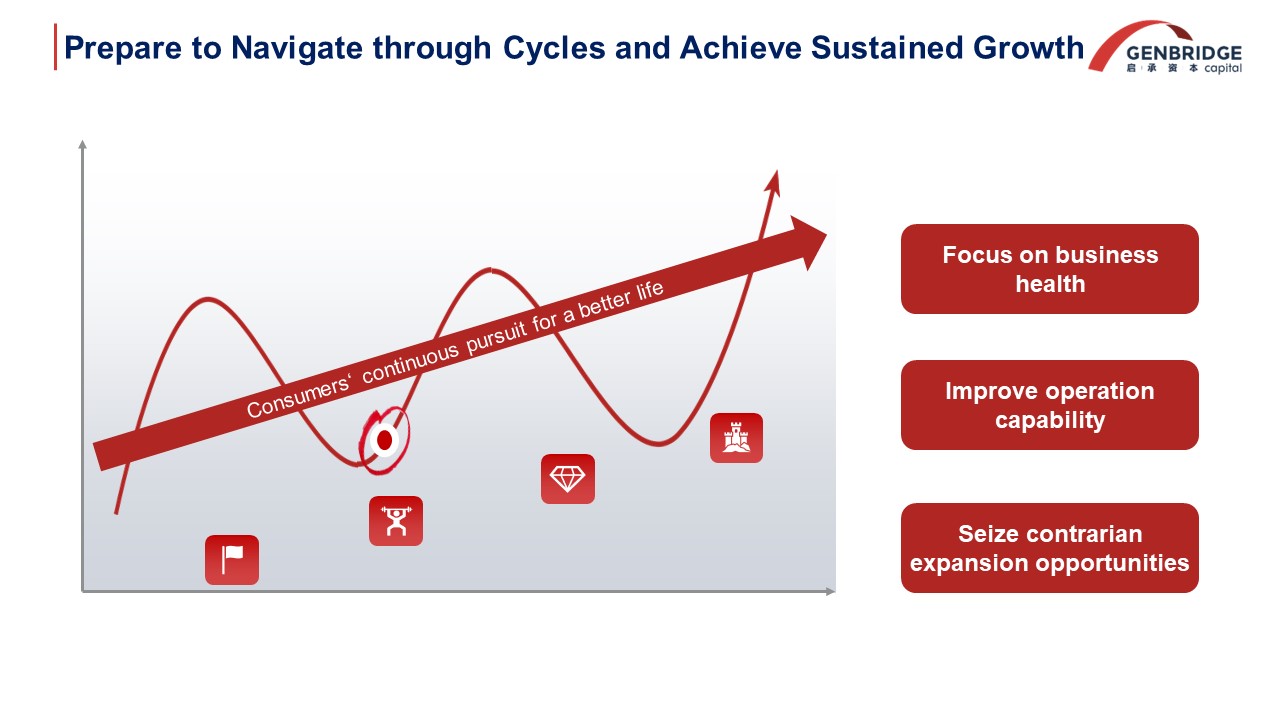

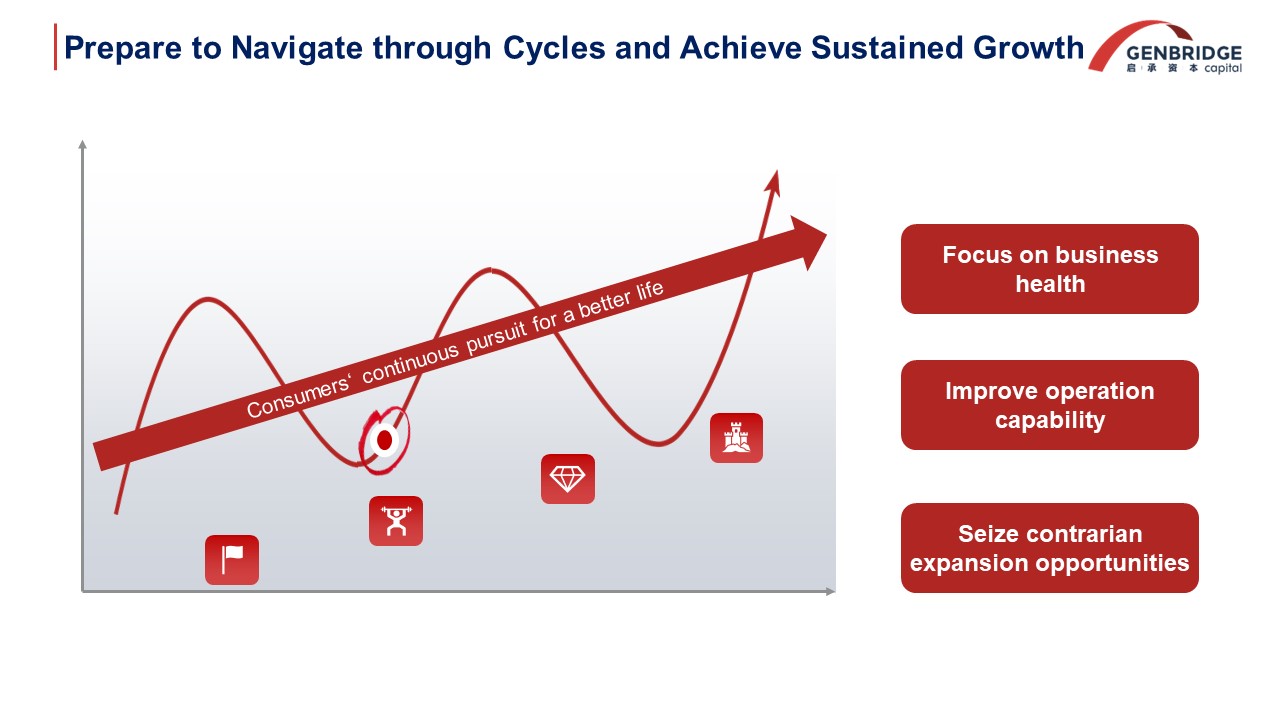

While China’s consumer opportunities dwarf Japan’s, growth trajectories are seldom linear. Over recent years, our pioneering founders faced unprecedented challenges. Reflecting upon our journey, I’m reminded of our collective resilience and vision. Through market cycles, we’ve prioritized business fundamentals, healthy performances, cash stewardship, and operational excellence. Many companies seized expansion opportunities against the odds, scaling new heights. Recognizing that cycles are inevitable, I trust our portfolio companies are well-prepared for a sustainable future.

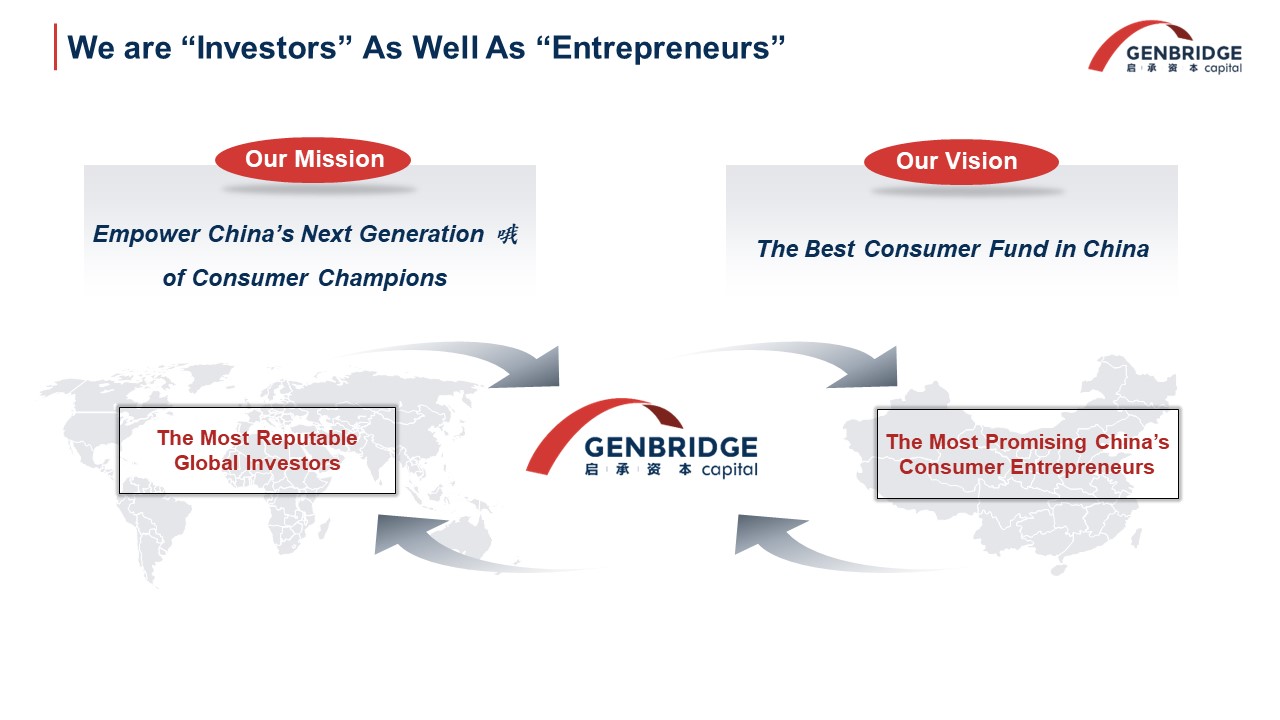

In conclusion, GenBridge Capital is, the same as everyone else, an entrepreneur, and our entrepreneurial journey is anchored in “connection”. Entrusted with our invaluable LPs, we are committed to nurturing China’s most promising entrepreneurs, fostering truly impactful ventures, and catalyzing the rise of China’s next generation of industry leaders. We extend our heartfelt gratitude for your unwavering support and look forward to collectively realizing our championing aspirations. Thank you!