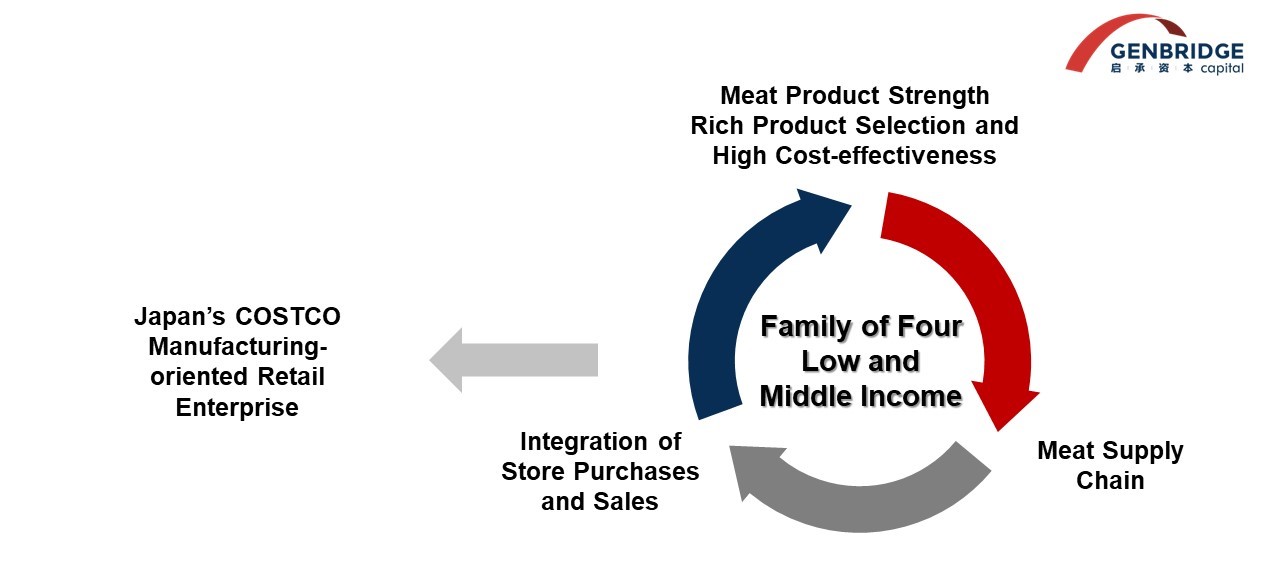

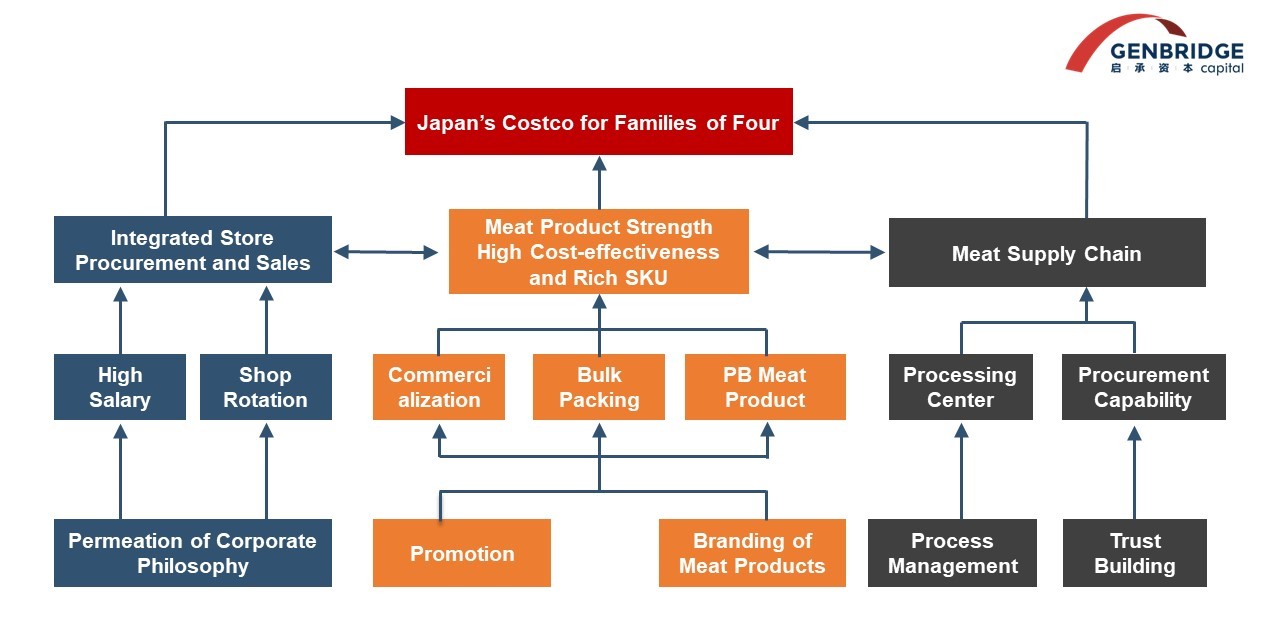

How does Lopia meet consumers’ latent demand for meat?

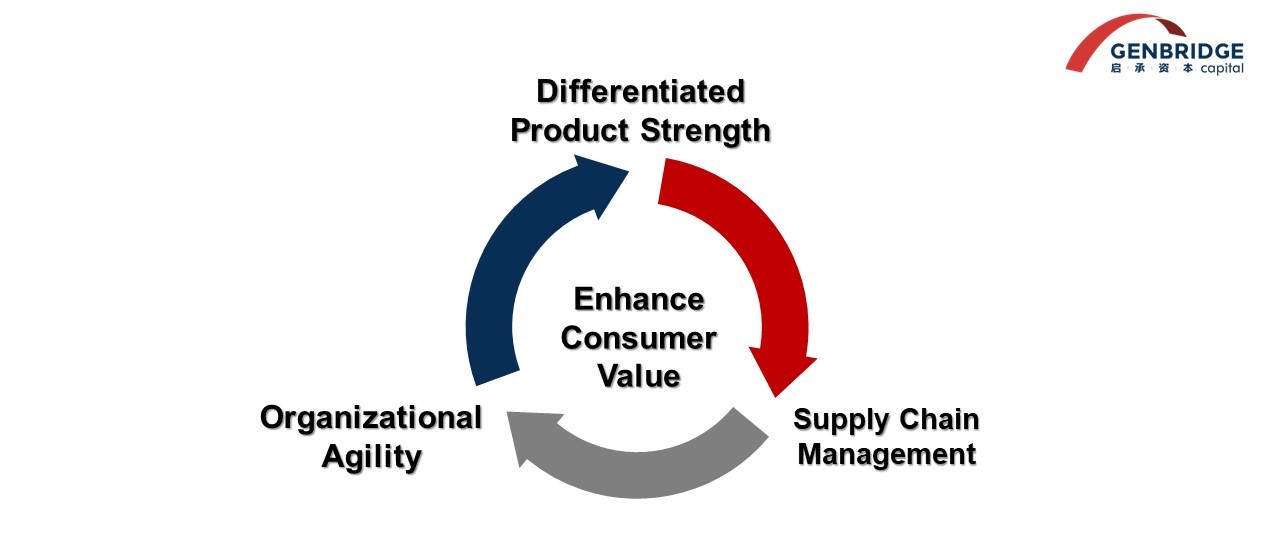

The answer lies in three key aspects: choosing, producing, and selling.

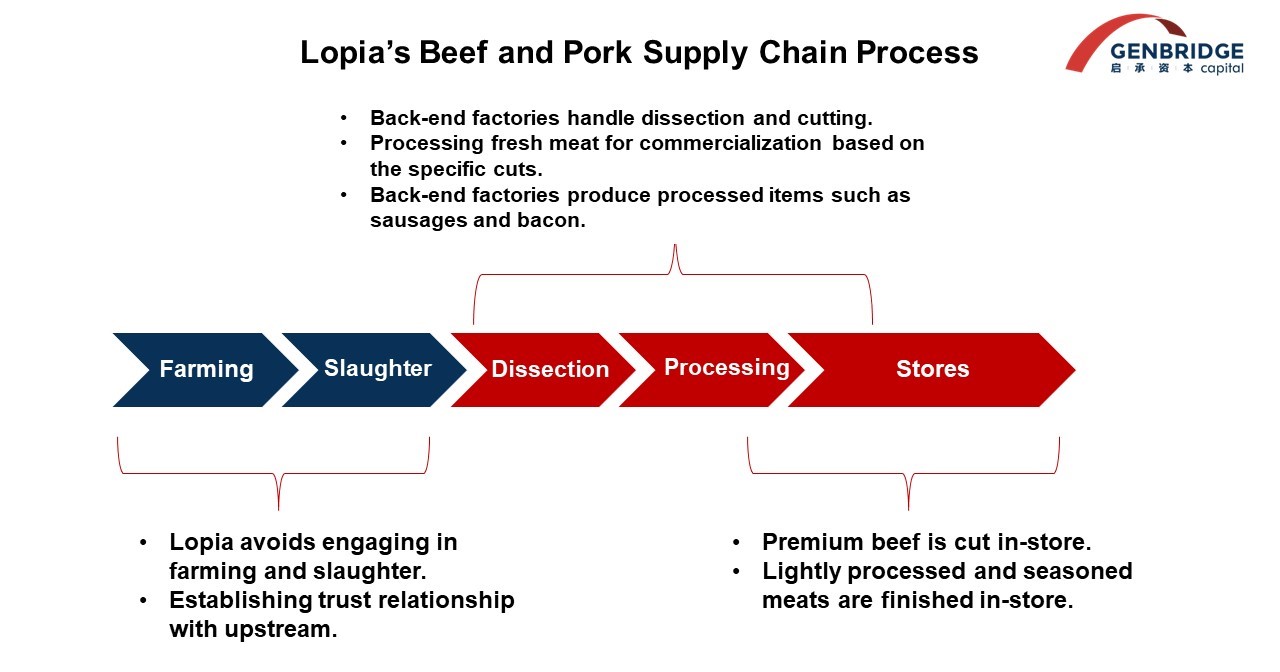

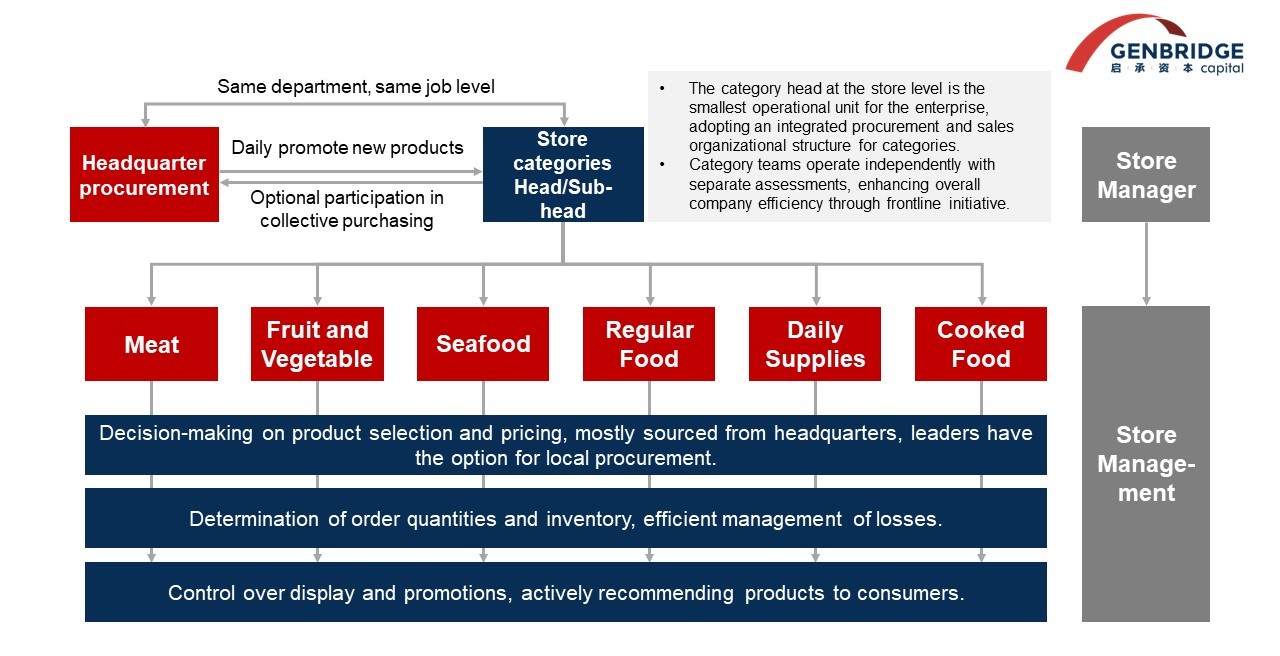

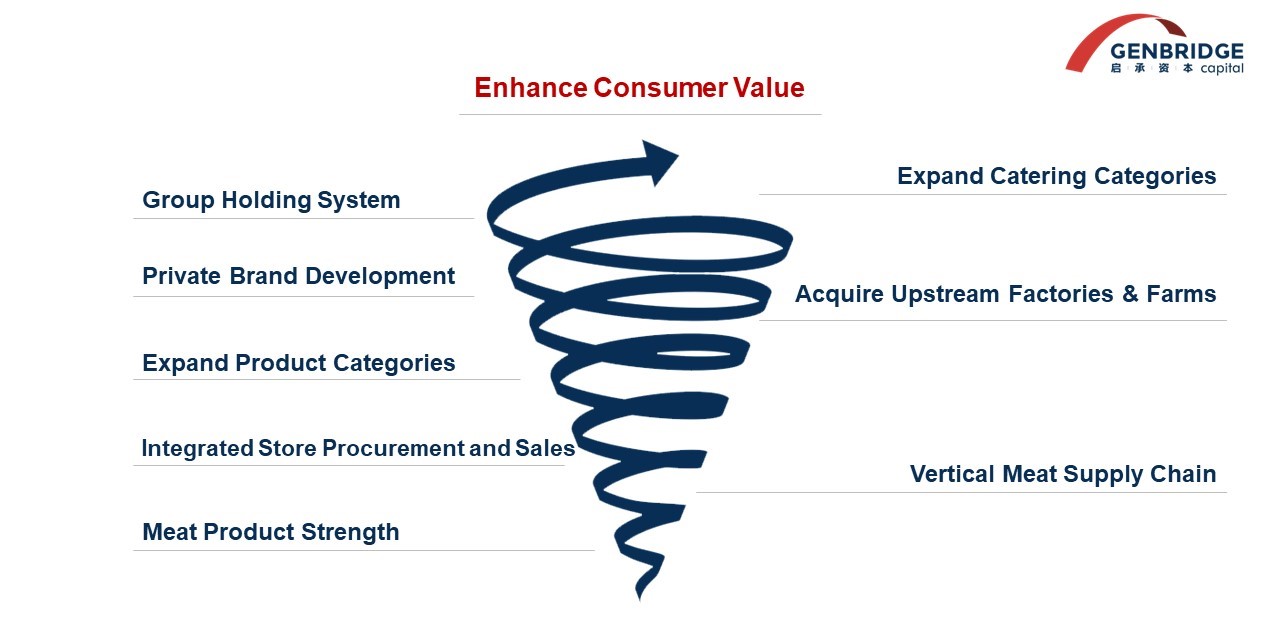

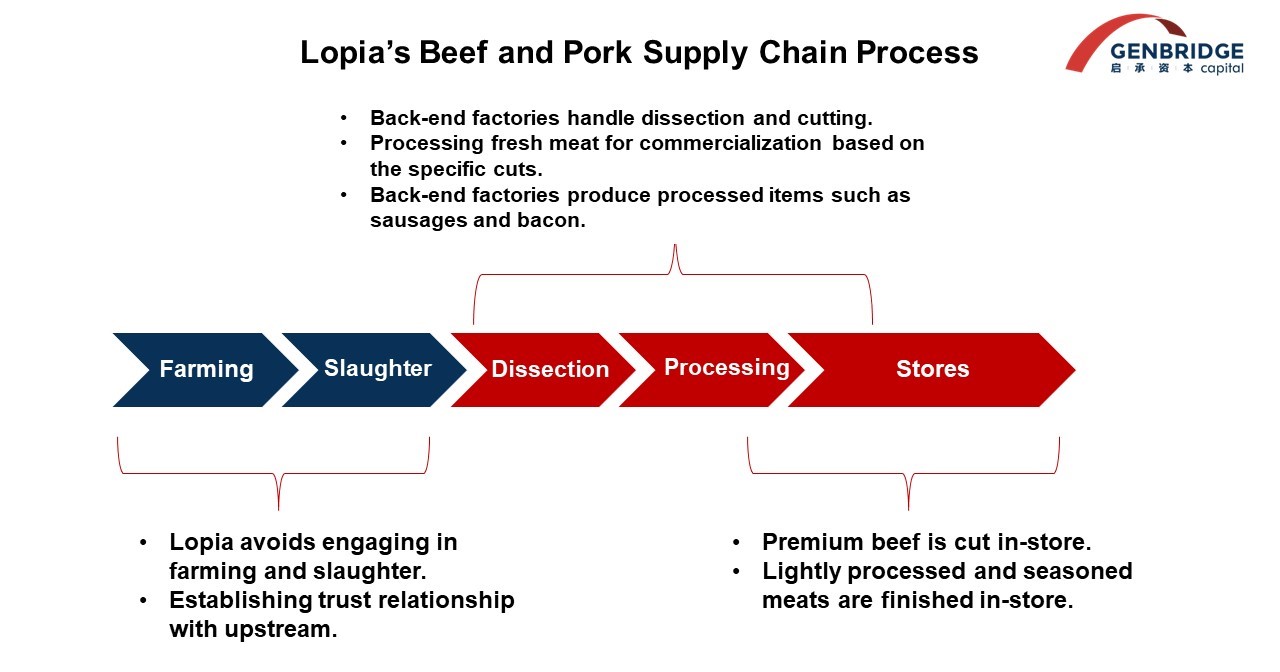

Choosing: This refers to the method and quality of procurement. Unlike regular supermarkets in Japan that simplify operations by purchasing different cuts of beef and pork, and then conducting cutting and selling at the backend factory or store, Lopia engages in multi-part/whole-head procurement. This method requires assessing the yield after cutting during procurement. Rooted in its origins as a meat store, Lopia has accumulated rich experience and channels in meat procurement.

“Choosing” also means establishing stable trust-based relationships with upstream suppliers. Founder Hidetake Takagi still visits the meat wholesale market every morning to personally procure raw materials. This proactive approach is a form of respect for upstream wholesalers and farmers. For livestock farmers, if the prices offered by various buyers are similar, they prefer to sell their hard-raised livestock to companies that treat them well and can market the products effectively. According to a meat expert, suppliers at the Yokohama meat wholesale market are willing to provide Lopia with a few extra points of margin. Additionally, Lopia primarily relies on cash purchases, and most stores do not accept credit card payments.

Producing: This involves channel-based commercial development of meat products. Lopia has extensive experience in the commercial processing of various meat cuts, maximizing the sale of high-value cuts with higher profit margins. Furthermore, Lopia processes meat into different forms, allowing consumers to choose pre-cut products based on recipe requirements. Through different cutting methods, different cuts, and different price ranges, Lopia achieves a diverse range of meat products.

Lopia noted the flavor difference of different parts

On this basis, Lopia blends the profit of various cuts of meat from a whole head/animal. The cost of purchasing in multi-part/whole-head method is about 15% lower than purchasing individual cuts. However, this method also tests the channel’s ability to utilize various cuts of meat; purchasing without efficient utilization increases costs. Lopia effectively uses the scraps generated during cutting and production in the backend factory. While other channels may discard these scraps, Lopia utilizes them to create products such as sausages, ham, hamburger meat, and more.

Lopia’s Private Brand meat products are more than 30% cheaper than National Brand standard goods and reach the same taste level. These PB products, including sausages, contribute to the source of Lopia’s meat profits. Lopia’s self-owned sausage products have a full-chain gross margin of over 50%, and some marinated seasoned meat products can achieve a gross profit margin of up to 80%. These products are prominently displayed in Lopia stores, using a large quantity of individual items.

To further enhance the added value brought by self-processing meat products, Lopia has also introduced distinctive ready-to-eat products. Lopia’s ready-to-eat products do not include seafood, vegetables, or other categories outside of meat products. All ready-to-eat products revolve around maximizing the value of meat products. For example, Lopia’s freshly baked sausage and bacon pizza (27 RMB) cleverly utilizes the value of freshly baked pizza and the meat product image of the Lopia brand, becoming a star product in the ready-to-eat category. With the profit support from these product categories, Lopia can offer beef products with the strongest consumer value at lower prices.

Freshly baked sausage and bacon pizza at Lopia

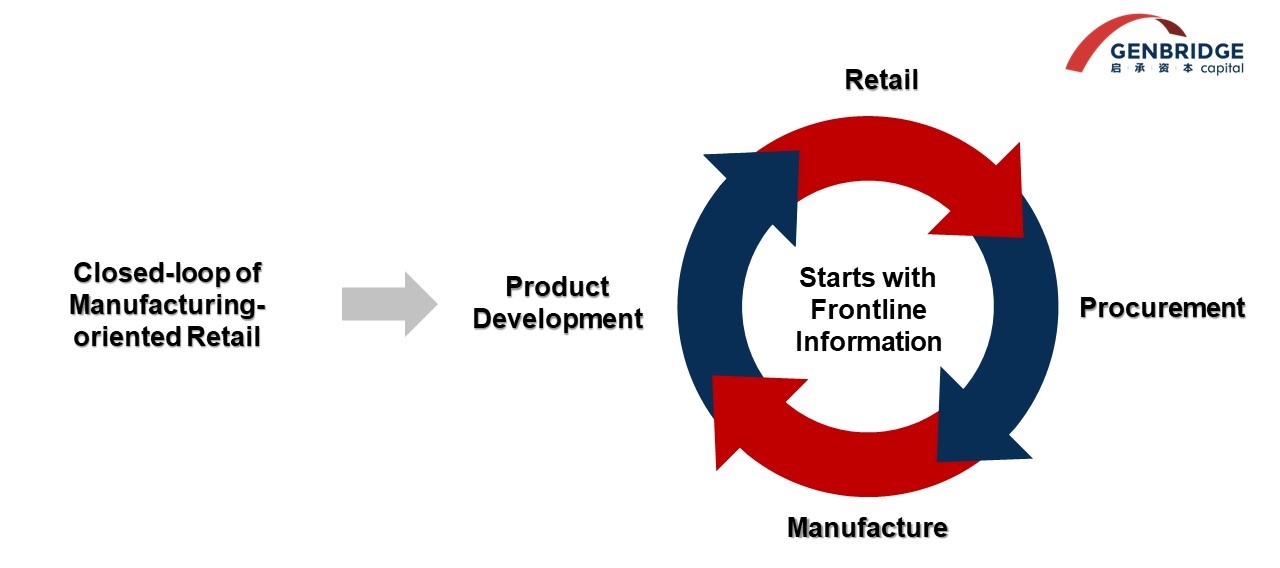

Achieving exceptionally high profits through meat products signifies the transformation of the backend meat processing factory from a cost center to a profit center. The traditional meat processing factories of chain channels typically function as a “sorting center,” primarily focusing on portion control. For instance, after the slaughter of pigs, when transported to the factory, the backend factory decides which parts to use for fresh cuts, which to freeze, and which to wholesale to catering channels, managing comprehensive cost and loss control. However, Lopia amplifies the product development function of its backend factory, utilizing different cuts through processing techniques and commercialization thinking to maximize profit.

Lopia has also organized its meat processing facilities based on different product price bands. The backend factory mainly handles the processing and commercialization of mid- to low-end meat, achieving maximum efficiency with the lowest labor cost. The factory has imported production experience from the world’s largest electric motor company, minimizing costs throughout the entire process. Store processing mainly focuses on cutting high-priced domestically produced premium beef, effectively controlling losses while providing consumers with a stronger sense of value.

Lopia’s meat processing factory

The inherent characteristics of meat products contribute significantly to Lopia’s strong image of cost-effectiveness and high quality. However, achieving good quality is not solely a matter of waiting; it requires effective strategies to promote and sell the products. This involves strategies such as establishing price perceptions, store marketing activities, and promoting brand value.

Lopia establishes a perception of high cost-effectiveness through the anchoring of prices with slices of premium beef. While the gross margin for this category is only about 15%, the selling price is less than half of that in department stores and 30% cheaper than other food supermarkets. The price of premium beef at Lopia ranges from 20 to 25 RMB per 100g, allowing consumers to buy a slice of beef with snow-like meat quality for only around 50 RMB. Because premium beef is not a daily purchase for Lopia’s target consumers, they may not fully understand the price, creating an impression of “affordability.”

Grade 4 “Source Beef” Thick-Cut Slices 130rmb/539g; Kumamoto-Produced Beef Steak Meat, Frost Drop Shoulder Core Muscle Meat 110rmb/440g

The variance between the expected quality and price of Lopia’s beef comes from the branding of Lopia’s beef. The premium Wagyu product line from Lopia is named “Gen Beef” and has its own set of grading criteria. However, “Gen Beef” does not have strict environmental requirements for breeding like “Kobe Beef” or “Matsusaka Beef”; it is a general term used by Lopia for domestically produced high-end black-haired beef. This branding approach leads consumers to believe that “Gen Beef” is close in quality to “Kobe Beef” and “Matsusaka Beef.” In reality, the taste of “Gen Beef” is not on par with true branded beef, but this is not crucial for Lopia’s consumers.

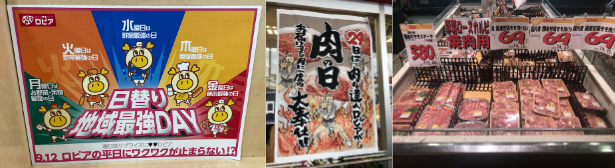

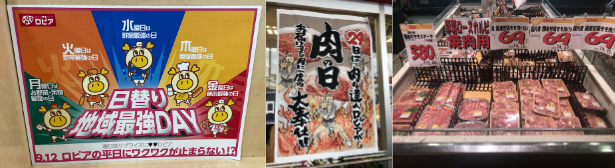

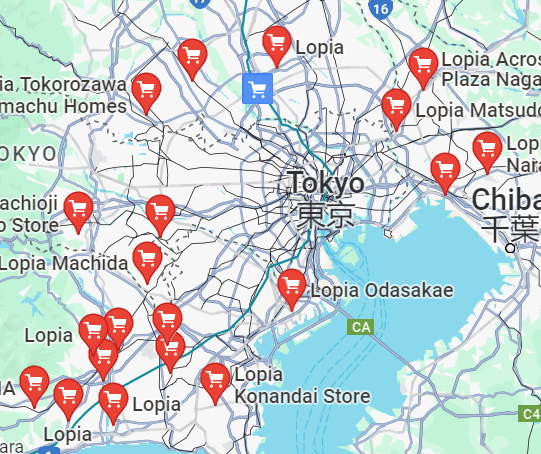

In terms of sales, Lopia actively employs flexible promotional activities, leveraging the channel’s perception of low-cost, high-quality meat to attract consumers. For example, Lopia holds a “Meat Day” promotion on the 29th of each month (29 is a homophone for “meat” in Japanese), which has become a day many families visit Lopia. Additionally, Lopia has “Local Strongest Day” promotions every day other than weekends, offering specific items at the lowest regional prices. About 3% to 6% of the product SKU quantity is on rolling promotions.

Regional Strongest Day Poster; Lopia Meat Day Poster; Lopia’s Meat Product Promotion

Yutakaraya Koenji store

Yutakaraya Koenji store